Current and Future Risks and Opportunities in Real Estate Debt

The COVID-19 pandemic had a fast and widespread effect on commercial real estate (CRE) as it has had on many other sectors in the economy. Entering the current crisis, fundamentals were sound, and market liquidity was strong, but opposed to other crises, in a very short time, many operations came to a complete stop as people were advised to practice social distancing, and some businesses, such as movie theaters and restaurants, were ordered to fully or partially shut down. Commercial real estate transaction volume fell during Q2, with only $23.4 billion in U.S. assets changing hands during April and May — a -73% decline from one year prior. COVID-19 has accelerated secular shifts in demand, and changing lifestyle habits have resulted in many people favoring lower-density secondary cities, low-cost/low-tax states, and life sciences/tech hubs. The outlook for property prices and defaults remains uncertain and dependent on the economic recovery and continuing support from the federal government.

As we wrote back in the memo, The Other Side of Real Estate Investments, in 2019, we were not as keen on new allocations to real estate properties for two main reasons: Very low cap rates and the indications we saw that we are in the later stages of the cycle. Instead, we preferred real estate debt as a strategy, from which clients benefited. In this memo, we look at some of the challenges and opportunities we see in real estate debt.

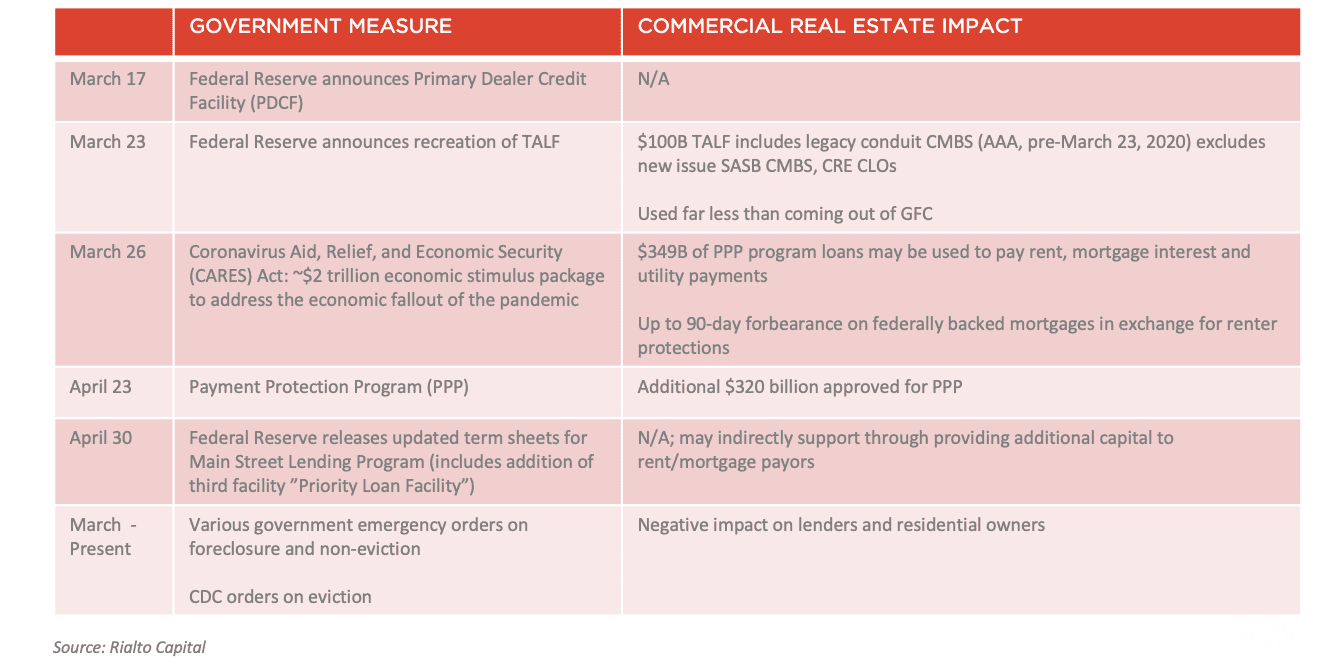

Government Intervention

Historically, government intervention in commercial real estate has been limited, as its role is limited to residential properties. When it does intervene, it is usually by setting the policies for banks’ lending and other regulations, or via the Federal Reserve by purchasing assets such as commercial mortgage-backed securities (CMBS). In the current crisis as well, support to commercial real estate is limited, as can be seen in the table below:

Other new legislation was introduced to specifically provide relief to the CRE sector by authorizing the Treasury to guarantee preferred equity investments backed by CRE mortgages or make preferred equity investments in qualifying CRE companies.

Banks Are Not So Eager to Lend

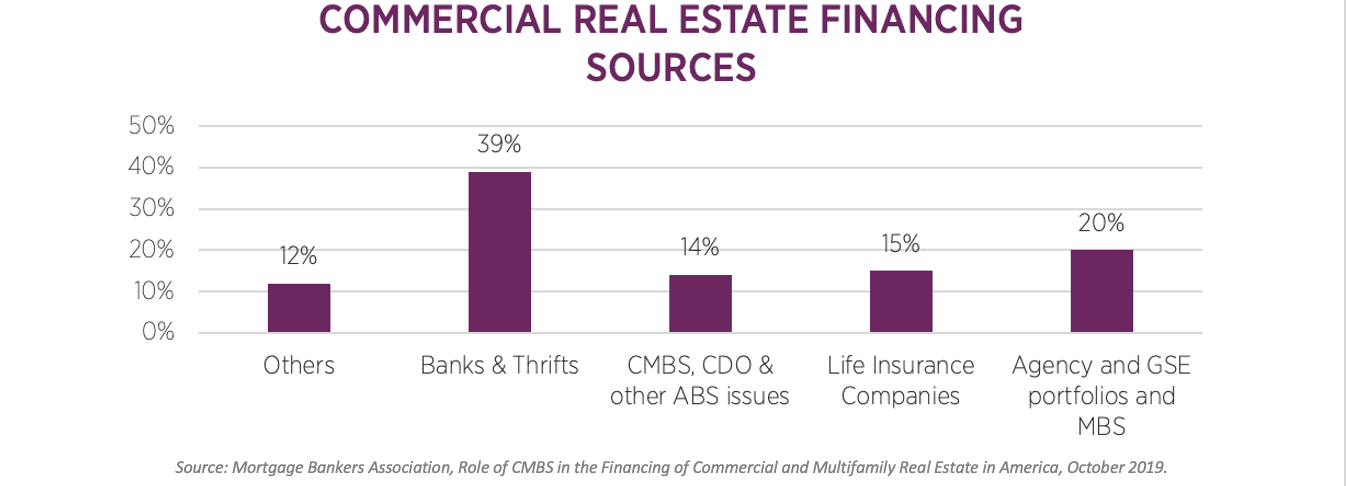

Banks are the largest and critically important lenders to commercial real estate. Just as they did at the financial crisis in 2008, banks have significantly tightened their lending standards, taking away much-needed liquidity in the real estate market.

The paragraph below is from the Senior Loan Officer Opinion Survey on Bank Lending Practices for Q3 2020.

“Over the third quarter, major net shares of domestic banks tightened standards for construction and land development loans and loans secured by nonfarm nonresidential properties, while a significant net share of banks tightened standards for loans secured by multifamily residential properties. Meanwhile, significant net shares of domestic banks reported weaker demand for all three CRE loan categories during this period. Similarly, major net shares of foreign banks tightened standards on CRE loans, and significant net shares of foreign banks reported weaker demand for such loans.”

In addition, banks reported weaker demand for construction and land development loans, nonfarm nonresidential loans, and multifamily loans.

This funding void creates an opportunity for private lenders to step in and gain market share at a more favorable environment for lenders, higher spreads and stronger covenants.

Debt Maturities

In the next few years, we expect to see a significant amount of debt maturities, as shown in the table below. We believe it will take some time for the real estate markets to work through this downturn, and many loans will mature into a difficult market. In addition, with banks tightening their lending standards, borrowers will find it hard and more expensive to refinance their debt.

Short-term rates are expected to stay low for several more years

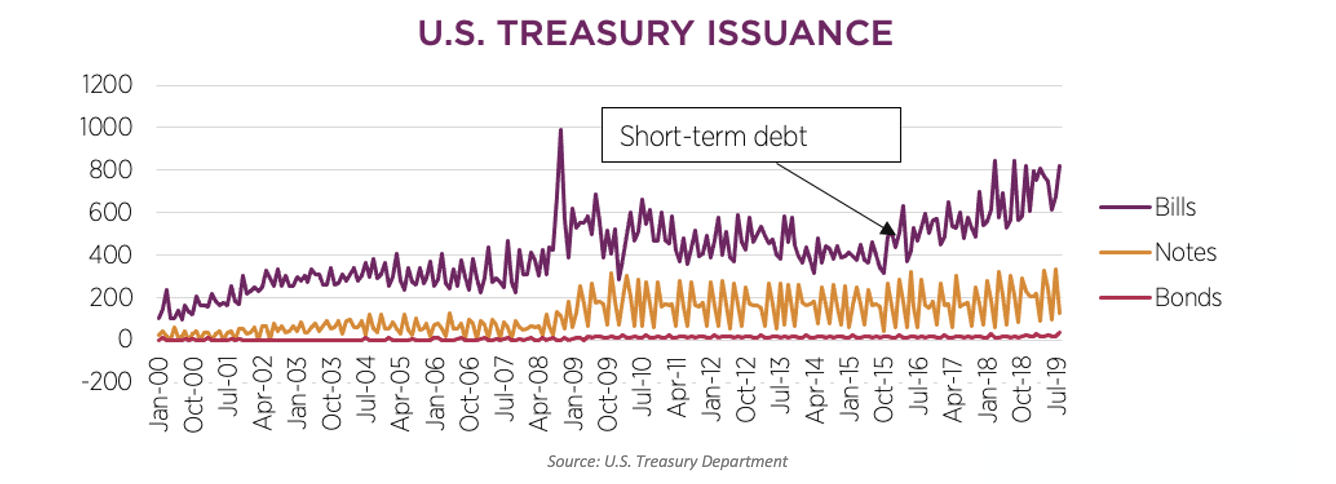

This is also something we wrote about at length in the last two years. Short-term interest rates are not going anywhere. On several recent occasions, Federal Reserve Chairman Jerome Powell emphasized the Fed’s intention to hold rates at current levels or lower.

In addition, as can be seen in the chart below, a significant and growing amount of the debt issued by the Treasury is short term at very low rates/yields. This means the Treasury, and for that, the Fed, cannot and will not allow short-term rates to go higher; they can’t afford it. (In fact, short term is the only rate they really can control).

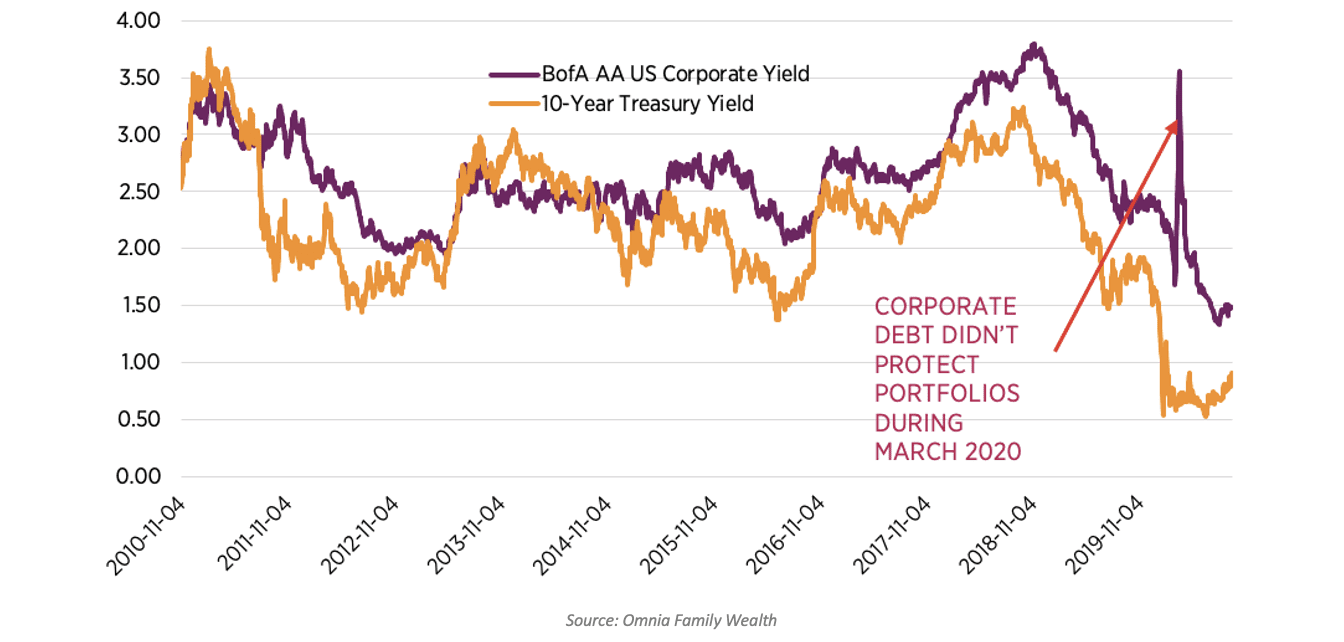

Long-Term Rates Could Be Heading Higher in the Intermediate Term

Long-term rates, measured by the U.S. 10-year Treasury, have been very low for a few years now but fell further once the COVID-19 crisis hit and the Fed started heavily buying bonds. But as we wrote in 2019 in our memo, The Setup for Higher Long-Term Yields, “The bottom line is we don’t know what will happen to long-term yields. Really, nobody does, but there’s a setup building that could cause yields to spike. Most investors are not prepared, and this is something portfolio managers should be aware of and prepared for. In a world where corporations heavily depend on cheap long-term credit, the magnitude of such a shift could be considerable”.

For this reason, high-grade, real estate debt could be an important addition to a portfolio. As long-term rates rise and corporate bonds lose value, the rate on the real estate loans will adjust higher, increasing investors’ returns.

In addition, and most importantly, as we saw in March 2020, even high-grade corporate debt will not protect portfolios in the next market meltdown. Investors must realize that at these levels, most corporate debt offers more risk than return.

Challenges for Private Real Estate Debt Funds

As in most real estate debt and equity strategies, managers depend on leverage. Many real estate fund managers who relied on mark-to-market credit facilities had to make payments during March and April, while at the same time, their lenders tightened requirements for new loans significantly.

This is the first time since the great financial crisis that managers had to deal with increasing defaults and the need for loan and covenant modifications. Many of them lack that important experience.

Many managers found that the biggest challenge is handling foreclosed properties. Once the manager forecloses on a property, the fund becomes an owner. That could become a drag on the fund’s returns and add additional costs involved with maintaining the property. Then the manager needs to sell the property into an already distressed market.

On the one hand, managers need to offer an attractive rate to borrowers to compete with other sources and funds. On the other hand, the manager must understand the loan’s real risk and how it should be priced. When pricing a new loan post-COVID-19, managers have to assume some long-term or permanent vacancies, higher maintenance costs and lower leasing rates.

In a distressed market, price discovery is limited, and underwriting becomes much more challenging. As of Q2 2020, commercial real estate transaction volume is down 67% — 70% in office, 40% in industrials, 70% in retail, 68% in apartments and 90% in hotels.

Summary

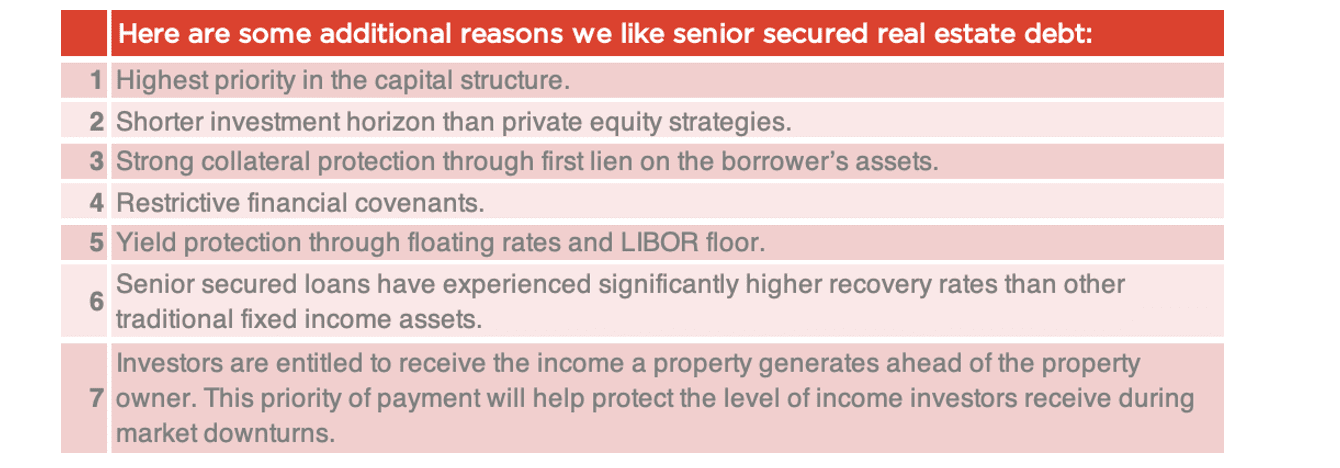

We see significant opportunity to fill an inevitable void in commercial real estate lending, created mostly by the pullback of the banking system, and take advantage of the current environment through investments in short-term real estate senior secured debt. Dislocation in capital markets left a void for the financing of transitional properties, predominantly multifamily, industrial and office.

Real estate debt is one of the only investments we see that has attractive risk-adjusted returns. We expect these returns to stay that way and possibly increase in the next couple of years. We also expect to see a favorable environment for lenders of senior floating-rate loans on transitional properties as owners facing an inefficient post-COVID-19 capital market.

We believe that the time period after a crisis is an especially attractive time to invest in commercial real estate credit. Historically, after a crisis, new lending activity is generally its most conservative in terms of property types, sub-markets, quality of assets, and leverage levels.

As always, we encourage investors to focus on strong managers with significant access to capital and robust networks and strong relationships with banks, brokers and sponsors. Having a robust industry network is key for attractive deal flow.

Managers with the best infrastructure, a strong balance sheet and a strong reputation are much better positioned to compete for what could be a smaller pool of institutional capital allocating to these strategies.

Also, as we mentioned above, experience in these environments becomes critical and could be the difference between a successful investment and a loss of an investment.

Click here to download the article.

Important Information

Omnia Family Wealth, LLC (“Omnia”), a multi-family office, is a registered investment advisor with the SEC. This commentary is provided for educational and informational purposes only. It does not take into account any investor’s particular investment objectives, strategies, tax status, or investment horizon. No portion of any statement included herein is to be construed as a solicitation to the rendering of personalized investment advice nor an offer to buy or sell a security through this communication. Consult with an accountant or attorney regarding individual tax or legal advice.

Advisory services are only offered to clients or prospective clients where Omnia Family Wealth and its representatives are properly licensed or exempt from licensure. Information in this message is for the intended recipient[s] only. Please visit our website https://omniawealth.com for important disclosures.

This content is provided for informational purposes only and is not intended as a recommendation to invest in any particular asset class or strategy or as a promise of future performance. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve.

The views expressed herein are the view of Omnia only through the date of this report and are subject to change based on market or other conditions. All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. Omnia has not conducted an independent verification of the data. The information herein may include inaccuracies or typographical errors. Due to various factors, including the inherent possibility of human or mechanical error, the accuracy, completeness, timeliness and correct sequencing of such information and the results obtained from its use are not guaranteed by Omnia. No representation, warranty, or undertaking, express or implied, is given as to the accuracy or completeness of the information or opinions contained in this report. This report is not an advertisement. It is being distributed for informational and discussion purposes only. Omnia shall not be responsible for investment decisions, damages, or other losses resulting from the use of the information. This report is not intended for public use or distribution. The information contained herein is confidential commercial or financial information, the disclosure of which would cause substantial competitive harm to you, Omnia, or the person or entity from whom the information was obtained, and may not be disclosed except as required by applicable law.

Statements that are non-factual in nature, including opinions, projections, and estimates, assume certain economic conditions and industry developments and constitute only current opinions that are subject to change without notice. Further, all information, including opinions and facts expressed herein are current as of the date appearing in this report and is subject to change without notice. Unless otherwise indicated, dates indicated by the name of a month and a year are the end of the month.