The U.S. Economy and the Wheelchair Effect

Let me use a metaphor to better explain what I think is happening to the U.S. economy today.

Imagine an Olympic marathon runner (the economy) – healthy and training routinely. He has some ups (growing economy) and downs (contracting economy) in his career, but overall doing very well.

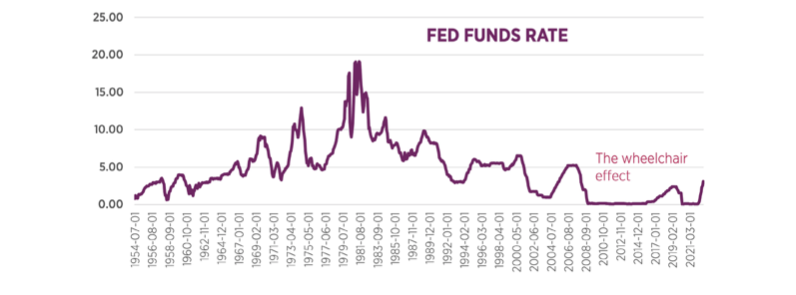

One day in 2008, the runner had an unfortunate accident and couldn’t run any longer. To fix the problem, the runner required a surgery (improvements in productivity, investment in new technologies, some debt default, and a reduction in excess capacity in various sectors of the economy) and a couple of years to recover. But instead, the doctor (the Fed) decided to put the runner in a wheelchair and support him with a constant dosage of medication (quantitative easing, zero interest rates and a bundle of dollar liquidity) for 14 years.

After 14 years of this “treatment,” the runner started having painful muscle spasms (inflation) and the doctor decides that it is time to stop the treatment due to these side effects and let the runner get back to his normal, former life.

But today, after 14 years of “treatment,” the runner is incapable of functioning in a normal environment. His muscles are weak, and his body is fragile. He can’t run a marathon or even just dance the “hora.”

By supporting the economy and the financial markets for so long, the Fed didn’t improve or strengthen the economy, but the opposite. The economy is more fragile and subject to extreme events (both positive and negative).

Continuing with the metaphor, inhibiting the natural healing process for a person who is sick eventually depresses his body and immune system. As time goes by, the body builds a lot of fat (debt) and excess capacity (zombie companies) and is now very sensitive to interest rates and dollar liquidity.

For this patient (the US markets and economy), not only has the “treatment” suddenly stopped, but a reverse process is now in action: the medication (QE and lower rates) has been pulled out at a record pace, which could lead to a shock to the system.

For a decade the central bank intervention reduced the availability of lower risk assets, forcing investors (including pension plans) to take higher risk and longer duration in their portfolios.

In the real economy, this situation created a massive debt maturity mismatch. Record levels of corporate and government debt that were built during the extended time of very low interest rates are now facing rollover risk due to much higher rates at a time when the economy is slowing.

The Fight for Dollars #1

We have written about this problem many times in the past. It’s a slow-moving train crash. The monetary and economic systems have become much more complicated, and it is critical to understand how they operate to be able to understand the potential economic outcomes. A good example of this complexity is the Bank of International Settlements’ recent report about the trillions of “missing dollars.” Huge, Missing and Growing:’ $65 Trillion in Dollar Debt Sparks Concern. In the report it seems as if these “missing dollars” is something new they just found out about, but in reality, this is nothing new. This is all part of the system called EURODOLAR that has been in place and growing for decades.

What they refer to as missing U.S. dollars is forex derivatives (mostly cross currency swaps) that accounting rules allow to be off the balance sheet. Global, non-U.S. companies need U.S. dollars to fund their operations, and these loans are collateralized by the exchanged currency and are being marketed frequently. So, nothing is really “missing.”

The problem is that this system is out of the oversight and control of the Fed – the U.S. central bank, which has oversight of global U.S. dollars flow and funding. When you hear about “dollar shortage” (which is often broadly misunderstood by the financial media), the main cause is the EURODOLAR system, an unsupervised funding monster, draining liquidity without warning. U.S. dollar up, everything else down.

The Fight for Dollars #2

It is well known that the U.S. fiscal situation isn’t great to say the least, and I don’t need to elaborate on it. Below is another recent example to the point I want to make. On October 31st 2022, the Treasury increased its Q4 borrowing from $400b to $550b (The U.S. Department of the Treasury announcement).

Federal spending in November was $501 billion, 6% higher than last year. How do you continue to finance deficits when interest rates are higher, the Fed isn’t a buyer due to inflation, and tax receipts are falling ($252 billion, 10% lower than last year)? At some point in the future, the Fed will have to finance the deficit or rates could spike significantly. Regarding foreign buyers of U.S. debt, think about this: For how long will the world sell the U.S. commodities such as oil and minerals (limited supply), and in return receive dollars to be reserved in treasuries which basically depreciate (supply increase) significantly every year?

To simplify: the challenge for investors is that as interest rates rise, financial assets go down in value, the economy cools down, people lose their jobs and corporations invest less. This, in turn, lowers the government’s tax receipts, which leads the government/treasury to raise additional debt, which causes yields on treasuries to rise. The higher yields push the U.S. dollar higher, which then push financial assets lower, which also negatively impacts tax receipts/income and so on and so forth. Basically, until this problem is fixed, the U.S. Treasury is competing with investors for dollars.

Ok, So What Does It All Really Mean for Investors

To summarize, I recommend investors change the way they think about portfolios. Investors should forget about asset classes. Should you add stocks or bonds? Hedge funds or real estate? This is all secondary. The first and most important thing for investors to do today is to make sure they are diversified across macro factors, not across “asset classes.” This will put their portfolios in a much better position to withstand an environment of changing rates and dollar liquidity. As we have warned for the last two years, when the economic environment will change, the correlations and behavior of assets will change, and “diversified” portfolios based on “asset classes” will become one big, same, macro trade. That’s what happened in 2022.

What I have described will dictate the most important events in the coming years and will have immense consequences, positive and negative, for private wealth.

Important Information

Omnia Family Wealth, LLC (“Omnia”), a multi-family office, is a registered investment advisor with the SEC. This commentary is provided for educational and informational purposes only. It does not take into account any investor’s particular investment objectives, strategies, tax status, or investment horizon. No portion of any statement included herein is to be construed as a solicitation to the rendering of personalized investment advice nor an offer to buy or sell a security through this communication. Consult with an accountant or attorney regarding individual tax or legal advice.

Advisory services are only offered to clients or prospective clients where Omnia Family Wealth and its representatives are properly licensed or exempt from licensure. Information in this message is for the intended recipient[s] only. Please visit our website https:// omniawealth.com for important disclosures.

This content is provided for informational purposes only and is not intended as a recommendation to invest in any particular asset class or strategy or as a promise of future performance. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve.

The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

No investment strategy or risk management technique can guarantee returns or eliminate risk in any market environment.

All investments include a risk of loss that clients should be prepared to bear. The principal risks of Omnia strategies are disclosed in the publicly available Form ADV Part 2A.

The major risks associated with investing in the natural resources sector, including large price volatility due to non-diversification and concentration in natural resources companies.

Investing in foreign domiciled securities may involve risk of capital loss from unfavorable fluctuation in currency values, withholding taxes, from differences in generally accepted accounting principles or from economic or political instability in other nations. Investments in emerging or developing markets may be more volatile and less liquid than investing in developed markets and may involve exposure to economic structures that are generally less diverse and mature and to political systems which have less stability than those of more developed countries.

For current Omnia Family Wealth information, please visit the Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov