The Setup for Higher Long-Term Yields

Do you remember a long time ago in 2016 and 2017, the biggest risk for bonds was the Fed raising interest rates and falling bond prices? Well since December 2018, this view has changed completely, and now most investors expect the Fed to lower rates and bond yields to go to zero or even lower.

This thinking is not farfetched, the amount of global sovereign debt with negative yield has passed $15 trillion, and recently we saw that corporate debt with negative yield passed $1 trillion. Even Greece, who just 10 years ago wasn’t able to sell $1 in bonds, just sold short-term debt at a negative yield, which means investors, voluntarily, are willing to lose money on the bond if held to maturity. When the trend reverses, it will be very painful for investors.

So, are US bond yields going lower? The bottom line is we don’t know what will happen to long-term yields. Really, nobody does, but there’s a setup building that could cause yields to spike. Most investors are not prepared, and this is something portfolio managers should be aware of and prepared for. In a world where corporations heavily depend on cheap long-term credit, the magnitude of such a shift could be considerable.

We see three main problems that together potentially create the setup for higher yields.

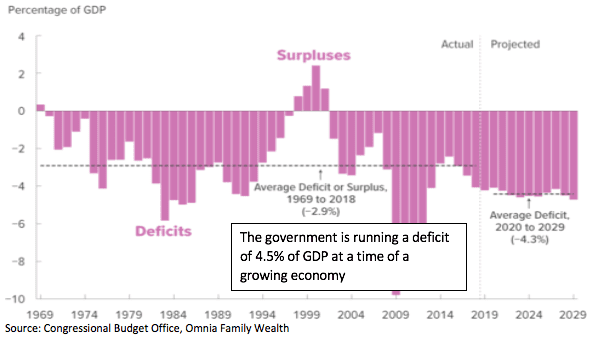

Problem #1: Ever-Growing US Deficit

Even if you do not follow the growing US deficit, a quick look at the chart below will make you understand the problem very quickly. The government is running a deficit of 4.5% of GDP and this is at a time when the economy is growing.

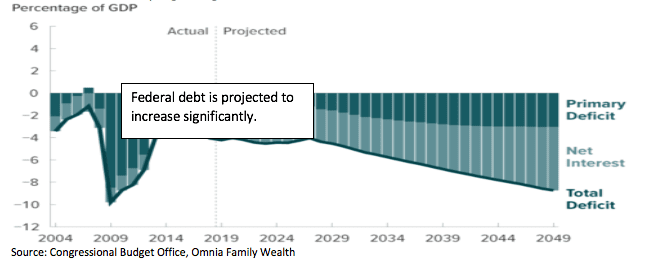

And based on the Congressional Budget Office projections, investors know there will be massive issuance of US debt in the coming years.

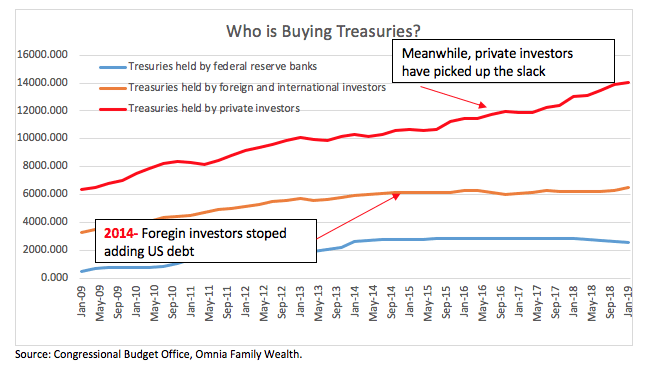

Problem #2: Large Foreign Investors in US debt Have Stopped Adding to Their Purchases

What this means is that private investors are picking up most of the new issuance. And together with problem #1, the US federal deficit is growing faster than foreign and domestic private sectors’ ability to absorb it.

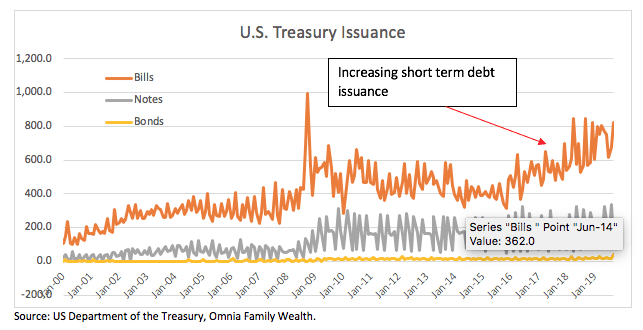

Problem #3: US Short-Term Debt Issuance Grows Massively

By issuing so much short-term debt, the treasury department actually “sucks” dollars out of the market and creates a liquidity squeeze or dollar shortage.

About 60% of the debt issued by the treasury department is short term, less than one year, which means they will be back selling large amounts of debt every year.

What’s the Setup?

As can be seen, there’s a growing need by the US to issue more debt, and they are issuing short-term debt while the demand for it is weakening. Putting this together we could see increasing pressure on the long-term government and corporate bonds, pushing yields higher.

Another significant risk is that Investors at some point realize that by purchasing bonds and injecting liquidity into the system, the Fed is basically financing the US government. This will not only affect yields but also the US dollar.

Is the Recent Anomaly in the Repo Market Related?

Yes, we think it is. And it’s not the first time we’ve seen this; these problems actually started in 2018 when the Fed started reducing the size of its balance sheet and taking liquidity out of the markets.

The event in the repo markets meant the Fed lost its control of the price of money, and once they realized that, a market intervention was inevitable, and the Fed announced it will be purchasing $60 billion a month in short-term treasuries.

What Could be a Solution?

To increase the demand for treasuries (because we can’t stop borrowing), we will need one of three things to happen: a meltdown in global financial markets, rising yield on treasuries, or a decrease in the value of the dollar which will make it cheaper for foreign investors to purchase treasuries.