The Fed’s Liquidity Conundrum and Short-Term Rates Dilemma

In March 2020, as a response to the pandemic, the Fed initiated quantitative easing at a massive scale. Currently, the Fed is still creating $120 billion through QE every month that supplies significant liquidity to the financial system. But has QE run its course, causing unwanted side effects?

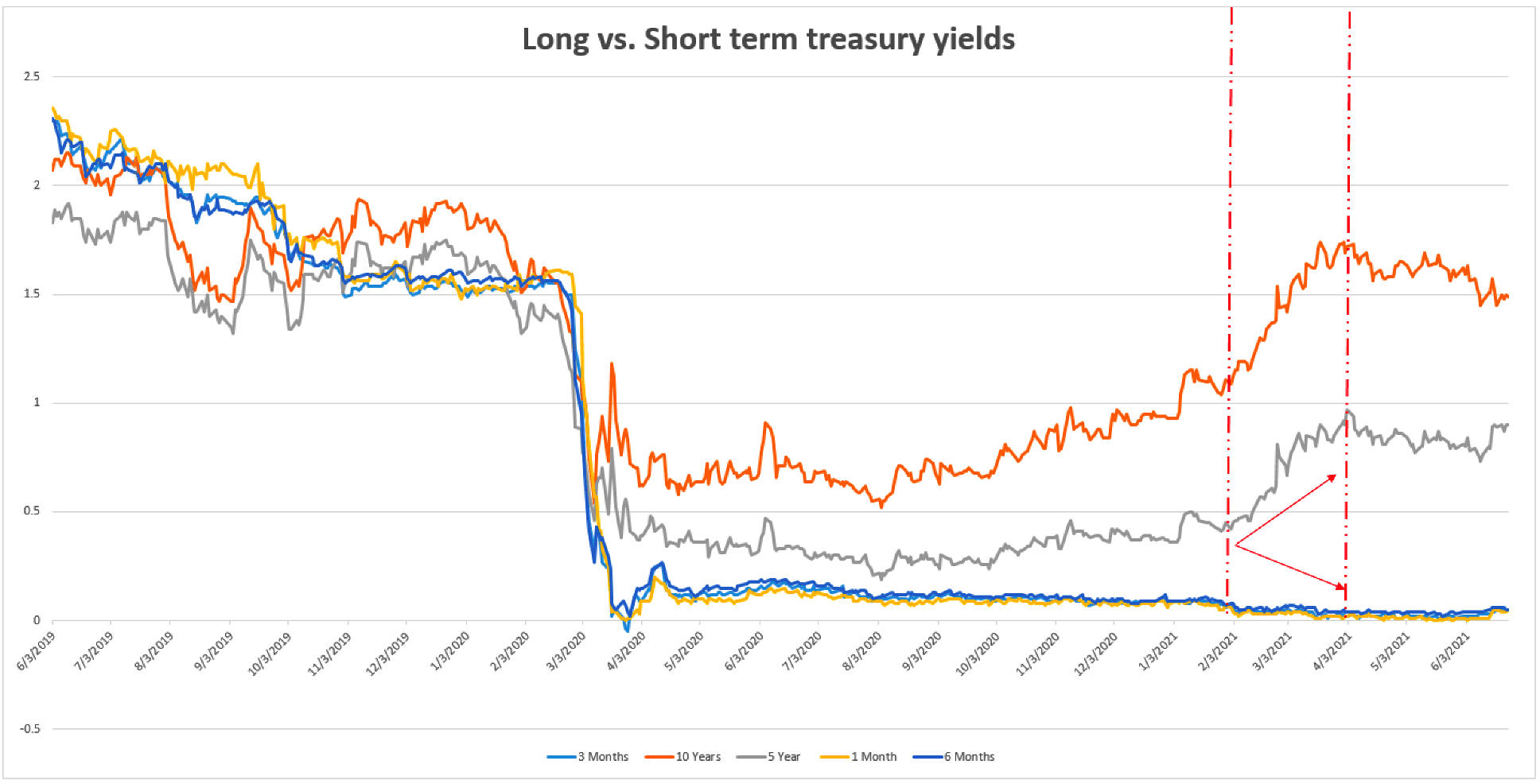

As the economy recovered from the pandemic and as inflation expectations rose, long-term yields started climbing slowly in August last year. Then in February this year, yields started accelerating higher. But short-term yields moved lower. That was the first sign something isn’t right. Then in April, long rates rolled over and confirmed the down trend in yields.

Source: FRED, Omnia Family Wealth

On June 18, investors were waiting to hear the Fed’s remarks after the FOMC meeting. The consensus was that yields will rise, but while the Fed was more hawkish than the market expected, Treasury yields actually continued lower.

My guess is that just like in 2018, the bond market is telling the Fed that under all this massive, ongoing stimulus, the economy is not as strong as it appears.

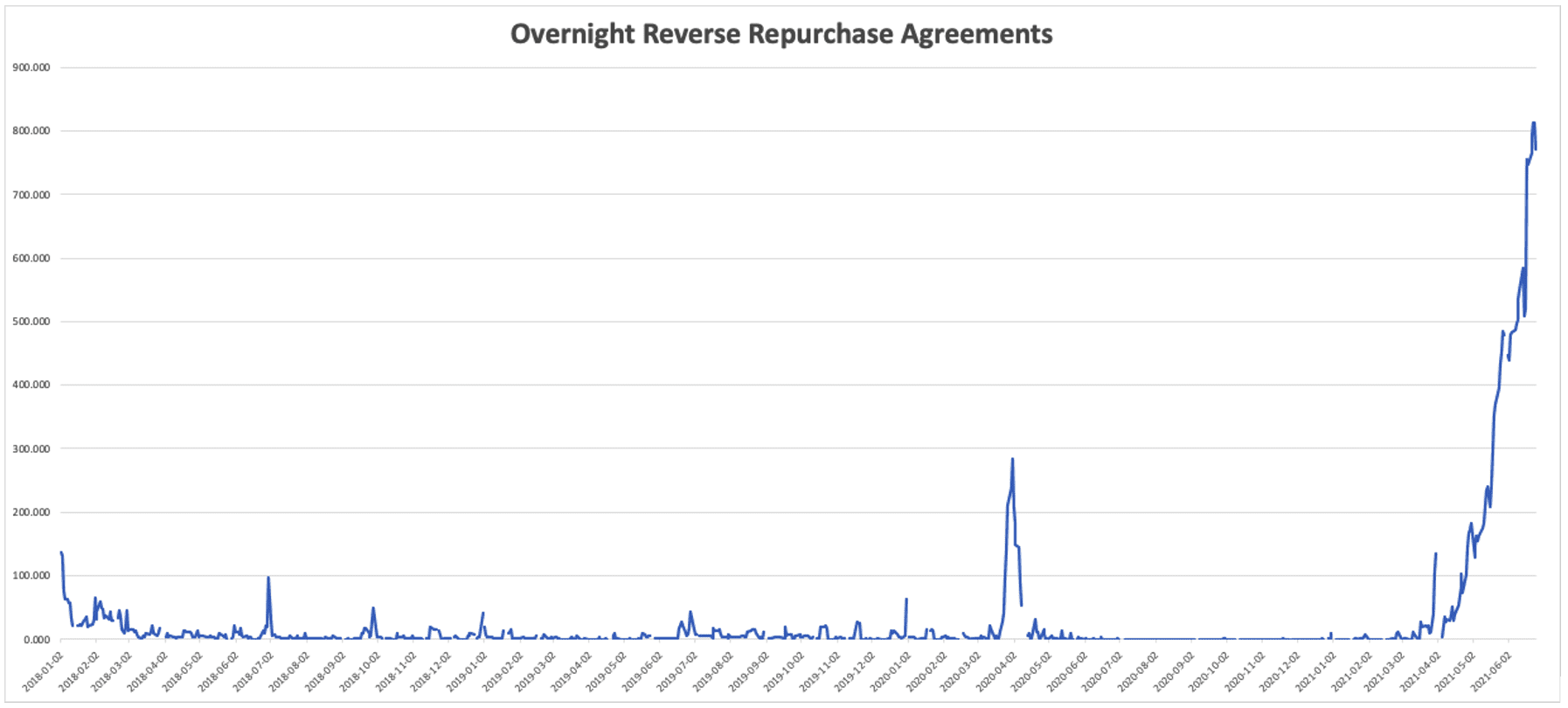

THE OVERNIGHT REVERSE REPO PROGRAM

A repo or “Repurchase Agreement” is a form of short-term borrowing in government securities, usually overnight but can be extended, where financial institutions holding securities can borrow cheaply from the Fed using the securities as collateral. A reverse repo is exactly the opposite where the Fed sells securities and raises cash in return. The Fed uses reverse repos to keep the federal funds rate in the target range. You can learn more about repo and reverse repo here.

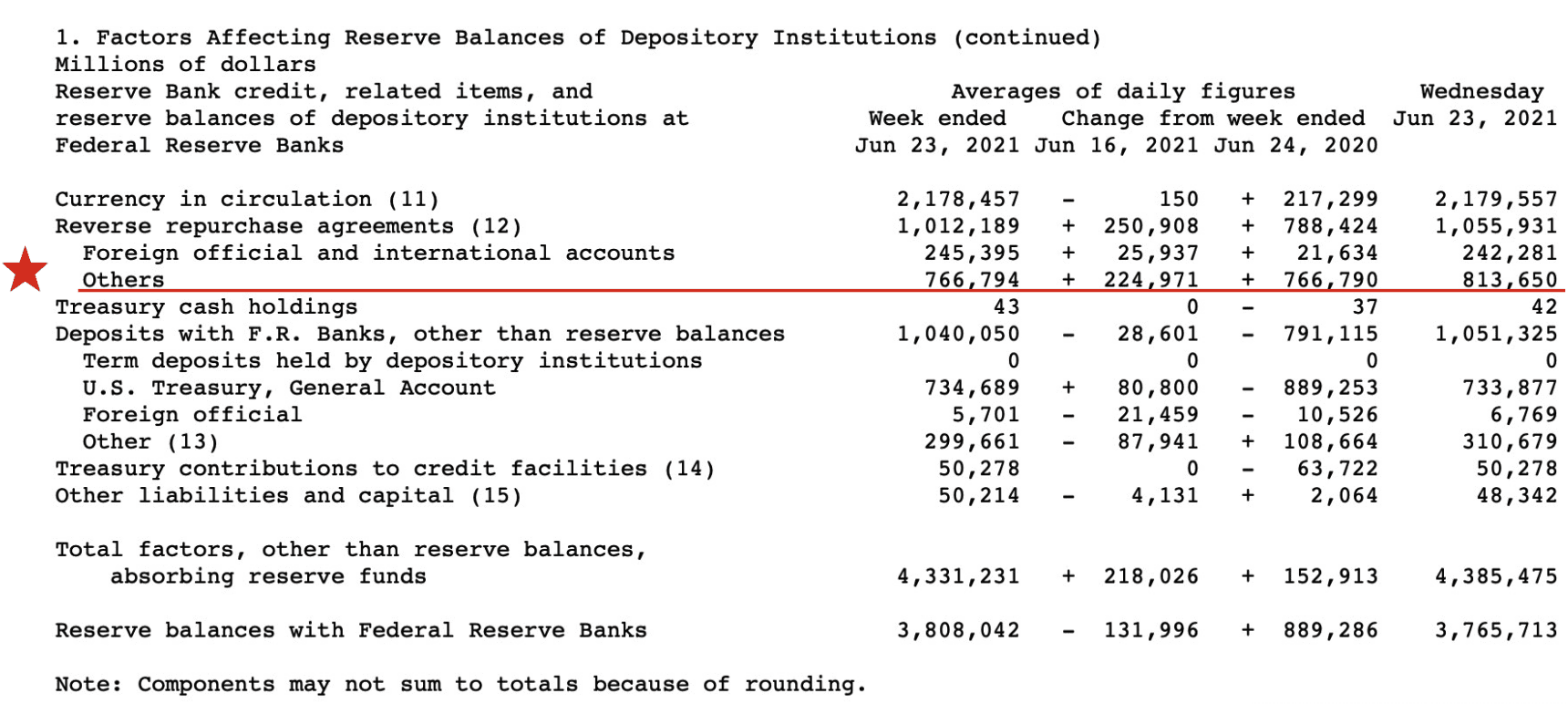

From May this year, we saw an increase in the Fed’s reverse repos operations (May 9 H.4.1. Report). On May 6, it was at $166 billion, on June 9 it stood at $487 billion, on June 16, $548 billion, and on June 24, it jumped to $766 billion. Looking into this, we found that many money market funds flooded with dollars needed a place to park some of the cash (which they receive 0% on) and turned to the Fed.

It seems the banking system can’t handle the massive liquidity the Fed is injecting into the financial system (which we wrote about here) and has reached an inflection point, which is why we see the Fed “sucking” money out of the system using reverse repos. There’s just too much liquidity. My interpretation is the Fed is mostly using this facility to prevent short-term interest rates from becoming negative, which would have significant unwanted implications.

Source: FRED, Omnia Family Wealth

H.4.1 REPORT- FACTORS AFFECTING RESERVE BALANCES

Source: https://www.federalreserve.gov/releases/h41/current/

THE SUPPLEMENTARY LIQUIDITY RATIO OR “SLR”

On March 31, the Fed terminated the supplementary leverage ratio (SLR) exemption for bank holding companies it announced last year in response to the Covid-19 crisis. The exemption allowed banks to exclude treasuries and other papers issued by the Fed from its SLR calculation. The SLR rule was designed to encourage banks to reduce their risky lending habits and to encourage them to instead purchase government debt. The SLR is the amount of liquid assets other than cash a bank has to hold in reserves before it can offer credit to customers. It is another tool to reduce systematic risk in the financial system. SLR = (tier 1 capital)/(total leverage exposure). The Fed also used SLR:

- To control the expansion of bank credit

- To ensure the solvency of the bank

- To “incentivize” commercial banks to invest in government bonds

- Control or adjust liquidity in the market

By excluding these treasuries, banks had more flexibility to lend money, accept deposits, and participate in the treasury market. But what the Fed didn’t take into consideration, by not renewing the exemption, is that as banks look to do something with the amount of reserves, they will reject and reduce new deposits which will send investors into money market funds that invest in T-bills, depressing short term yields even further.

THE RISK FOR MONEY MARKET FUNDS

The additional flow of money and the potential for negative short-term rates poses high risk to money market funds and to the financial system. These funds currently hold about $4 trillion.

Money market funds play an important role. They are a significant provider of overnight funding for corporations by purchasing commercial paper and for banks with acceptances and CDs. They are also large purchasers of treasury bills and repo agreements.

If short-term rates become negative, money market funds will struggle to generate positive returns, and investors would withdraw capital. This will then disrupt the overnight funding market and disrupt the smooth functioning of the financial system. That is the main reason for the increase in reverse repos operations.

The Fed is in a tough spot. Liquidity is a double edge sword. On one hand, falling long-term yields are telling the Fed the economy is not as strong without stimulus despite inflation fears, and talking about raising rates and tapering is premature. On the other hand, massive liquidity from ongoing QE has created some serious unwanted side effects like the risk of short-term yields turning negative. For many investors, these are background noises, and yes, the monetary system is very complicated to understand, but as we saw over and over again, it is critically important for understanding the potential implications of the Fed actions on liquidity and asset prices.

Click here to download the PDF.

Important Information

Omnia Family Wealth, LLC (“Omnia”), a multi-family office, is a registered investment advisor with the SEC. This commentary is provided for educational and informational purposes only. It does not take into account any investor’s particular investment objectives, strategies, tax status, or investment horizon. No portion of any statement included herein is to be construed as a solicitation to the rendering of personalized investment advice nor an offer to buy or sell a security through this communication. Consult with an accountant or attorney regarding individual tax or legal advice.

Advisory services are only offered to clients or prospective clients where Omnia Family Wealth and its representatives are properly licensed or exempt from licensure. Information in this message is for the intended recipient[s] only. Please visit our website https://omniawealth.com for important disclosures.

This content is provided for informational purposes only and is not intended as a recommendation to invest in any particular asset class or strategy or as a promise of future performance. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve.

The views expressed herein are the view of Omnia only through the date of this report and are subject to change based on market or other conditions. All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. Omnia has not conducted an independent verification of the data. The information herein may include inaccuracies or typographical errors. Due to various factors, including the inherent possibility of human or mechanical error, the accuracy, completeness, timeliness and correct sequencing of such information and the results obtained from its use are not guaranteed by Omnia. No representation, warranty, or undertaking, express or implied, is given as to the accuracy or completeness of the information or opinions contained in this report. This report is not an advertisement. It is being distributed for informational and discussion purposes only. Omnia shall not be responsible for investment decisions, damages, or other losses resulting from the use of the information. This report is not intended for public use or distribution. The information contained herein is confidential commercial or financial information, the disclosure of which would cause substantial competitive harm to you, Omnia, or the person or entity from whom the information was obtained, and may not be disclosed except as required by applicable law.

Statements that are non-factual in nature, including opinions, projections, and estimates, assume certain economic conditions and industry developments and constitute only current opinions that are subject to change without notice. Further, all information, including opinions and facts expressed herein are current as of the date appearing in this report and is subject to change without notice. Unless otherwise indicated, dates indicated by the name of a month and a year are the end of the month.