The Markets Are in a Free Fall, Now What?

In our recent memo, we discussed how we are likely far from containing the spread of the COVID-19 virus based on the growth rate of confirmed cases. We also showed several indicators suggesting US equity markets were susceptible to a sharp correction, even without COVID-19 being a factor. While this can feel overwhelming, we also discussed how a sound risk management process can provide a framework for reducing risk in investment portfolios. We discuss that framework in this memo.

At this point, while the market is still in free-fall territory, investors are considering their next steps. Even scientists and mathematicians are scrambling for answers, so how are the rest of us supposed to handle the known and unknown challenges we all face?

A Framework for Making Decisions

First, we have to remember that decision making should never be done in a vacuum or as an emotional reaction, and for that, we need a process.

The most effective and simplest method to use is making a list of different scenarios that may affect our portfolio and then assigning magnitudes and probabilities to each scenario.

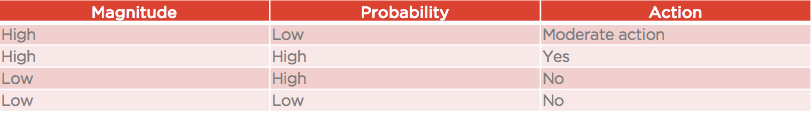

Here’s a useful framework for using the intersection of magnitude and probability to inform your decisions:

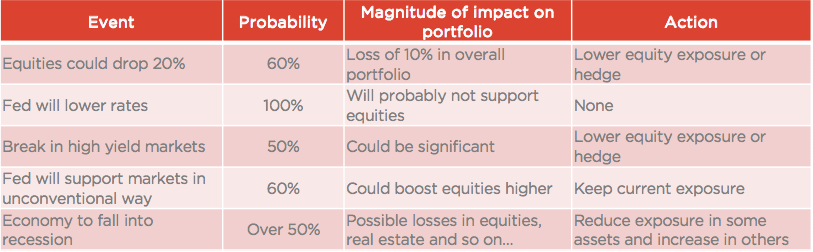

Here are a few hypothetical scenarios with their associated probabilities, magnitudes and suggested actions:

Of course, the list of potential scenarios could run on for pages, so it makes sense to focus on the ones that would have the greatest potential impact (positive or negative) on your portfolio.

Here are some good questions to be asking yourself:

- Based on your current asset allocation, what’s the worst-case scenario?

- How long might the spread of the virus continue?

- Once we see the number of new cases slow, how will the market react? How long could that take?

- What measures can the government take that will support financial markets? How probable is it that the government will implement those measures?

- Are there any assets or strategies that would benefit from an increase in volatility?

- Are there any assets or strategies that would benefit from lower interest rates?

Monetary and Fiscal Considerations

What Should We Expect From the Fed?

In an emergency move, the Fed cut rates by 0.5% last week. This was a rare action that last occurred in 2008. It’s likely that we will see short-term rates at 0% in the near future.

Unfortunately, there is no correlation between low interest rates and travelers’ willingness to risk catching an infectious disease by boarding a plane or cruise ship. Of course, the Fed knows this, but they had to start somewhere. Not to mention that last week’s cut was already priced in and expected by the market.

On Friday, March 6, we saw equity markets recover from session lows just before the market closed. This was a reaction to the Boston Fed President Eric Rosengren’s remarks.

In his comments regarding the unfolding coronavirus crisis, the collapse of treasury yields, and the possibility that those yields will hit zero, Rosengren said, “We should allow the central bank to purchase a broader range of securities or assets. Such a policy, however, would require a change in the Federal Reserve Act.” Why would he suggest something so extreme? Probably because he knows this time is different, and that rate cuts and additional quantitative easing aren’t going to cut it.

The Federal Reserve Act has been changed several times in the past (in 1932, 1945, 1965, and 1968) to enable the central bank to create more credit when needed. I would not be surprised to see it changed again.

What Should We Expect From the Government?

It’s always difficult to pass anything of significance in an election year, but this is an unusual situation where the whole nation is hurting. Nothing is out of the question. We could see tax cuts, temporary emergency funding, or even the full bailout of an industry.

Panic Is a Good Thing Sometimes

I often write about how media, and social media in particular, distorts reality and overstates any kind of bad news. That thought hasn’t escaped me this time around either, as the fear and horror stories coming out of these channels are out of proportion. But this time is different. People are in a state of panic and worried for their personal health, as well as that of their loved ones. Pay very close attention to the directives of national and regional health organizations and take appropriate precautions in order to slow the spread of this virus.

In the meantime, please stay safe and stay healthy.

Click here to download the article.

Important Information

Omnia Family Wealth, LLC (“Omnia”), a multi-family office, is a registered investment advisor with the SEC. This commentary is provided for educational and informational purposes only. It does not take into account any investor’s particular investment objectives, strategies, tax status, or investment horizon. No portion of any statement included herein is to be construed as a solicitation to the rendering of personalized investment advice nor an offer to buy or sell a security through this communication. Consult with an accountant or attorney regarding individual tax or legal advice.

Advisory services are only offered to clients or prospective clients where Omnia Family Wealth and its representatives are properly licensed or exempt from licensure. Information in this message is for the intended recipient[s] only. Please visit our website https://omniawealth.com for important disclosures.

This content is provided for informational purposes only and is not intended as a recommendation to invest in any particular asset class or strategy or as a promise of future performance. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve.

The views expressed herein are the view of Omnia only through the date of this report and are subject to change based on market or other conditions. All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. Omnia has not conducted an independent verification of the data. The information herein may include inaccuracies or typographical errors. Due to various factors, including the inherent possibility of human or mechanical error, the accuracy, completeness, timeliness and correct sequencing of such information and the results obtained from its use are not guaranteed by Omnia. No representation, warranty, or undertaking, express or implied, is given as to the accuracy or completeness of the information or opinions contained in this report. This report is not an advertisement. It is being distributed for informational and discussion purposes only. Omnia shall not be responsible for investment decisions, damages, or other losses resulting from the use of the information. This report is not intended for public use or distribution. The information contained herein is confidential commercial or financial information, the disclosure of which would cause substantial competitive harm to you, Omnia, or the person or entity from whom the information was obtained, and may not be disclosed except as required by applicable law.

Statements that are non-factual in nature, including opinions, projections, and estimates, assume certain economic conditions and industry developments and constitute only current opinions that are subject to change without notice. Further, all information, including opinions and facts expressed herein are current as of the date appearing in this report and is subject to change without notice. Unless otherwise indicated, dates indicated by the name of a month and a year are the end of the month.