The Roadblocks and Solutions to Efficient, Strong Compounding

We all understand the importance of compounding when investing long term capital. Charlie Munger once said that the first rule of compounding is to never interrupt it unnecessarily. It’s a brilliant statement, but one that is very difficult to put into practice. As Baron Nathan Rothschild said, “I never buy at the bottom, and I always sell too soon.”

Unfortunately, what most investors don’t realize about compounding is that the big numbers are more important than the small numbers, and that negative numbers have a far greater impact than positive numbers. The negative compound impact is much greater than the positive one.

THE FALLACY OF PREDICTIONS

One of the biggest mistakes investors make is listening to “gurus” who predict the rise or fall of a certain market, stock or anything else for that matter. These forecasts make you vulnerable to prediction errors, thereby increasing portfolio turnover, adding fees and overall hurting the compounding effect. If you go back in time, you’ll find there’s no one “guru” that keeps getting it right all the time, except maybe for the things you can’t make money on, like forecasting the next GDP print, for example.

Remember, in financial markets, there are years where nothing happens, and then there are weeks and days when years happen, and the average portfolio returns are disproportionately affected by few, but large, short-term sharp returns, either up or down. Recent events are a clear example of this, but investors focusing on the predictions of strategists or economists are bound to miss out on these important periods.

The other problem with following predictions or views is you are subject to things going your way, and you hope for as little deviation from the forecast or disruption as possible. When your wealth is positioned this way, every short-term event is magnified and suddenly important, whether it’s a recent jobs report, consumer sentiment report, GDP report, any political event or geopolitical event – suddenly they are all important to you. In reality, this is just short-term noise with no correlation or implication to your long-term performance or financial goals.

THE URGE FOR INSTANT GRATIFICATION

Investors have a strong need for instant gratification. In up markets, this urge increases as investors want to lock-in recent strong gains. Most of the time they sell, just to watch the asset keep going higher. The more volatile the asset, the stronger the urge. Because you do not want to lose your gains, you are hesitant to get back in the markets. Such behavior will keep you out of the most important market moves.

BEWARE OF THE RISK ADJUSTED RETURNS

Many wealth advisors like to show clients “deals.” The conversation eventually is focused on, “You can make 14%, and lose only X%.” Sounds great, but you could miss the overall picture.

Let’s look at a very simplified example to understand the problem. We bet $1,000 in a coin toss game. When we are right, we profit 50%, when we are wrong, we lose 40%. Sounds like a good way to achieve good risk adjusted returns the more we keep playing. But in reality, over the long run we will be bankrupt! Let’s say we were wrong on the first toss and right on the second. We lost 40%, so we now have $600 and then made 50%, but now we are back to only $900. The losses quickly deteriorate your portfolio such that your long-term gains, and the benefits of compound interest over time, are significantly damaged. Oftentimes, the risks are downplayed as the potential up-side becomes the selling point for a particular investment.

THE FALLACY IN DIVERSIFICATION

The conventional belief about diversification is that investing in non-correlated assets will prevent heavy losses as a result of bad performance in one asset. This concept is correct, but the reality is not that simple. Many investors assume they are diversified based on an asset’s historical correlation, only to find out at the worst time that the correlation between their “diversified” assets is very high when they all drop in value at the same time. There are many assets that presumably are not correlated, but actually share the same risk factors. Correlation between assets will change over time and in different economic environments. We see time and time again how investors deploy certain uncorrelated strategies that guarantee short-term returns while exposing them to massive potential losses.

To understand another important point about overall portfolio correlation, ask yourself this question: “Why would anyone who owns an American business that serves as a main source of income want to have high correlation between their business performance and their investment portfolio?” If the US experiences a sharp recession, or any other extreme negative event, would you want your portfolio to take heavy losses while your business also slows down? History gives us so many examples of how imprudent and devastating this can be, but no one seems to connect the dots.

PORTFOLIO CONSTRUCTION IS CRITICAL

The return profile of the vast majority of portfolios we examine is linear, or very close to being linear. This means that, for example, if an investor has a portfolio of $1,000,000, they have the same chance of making a large profit as having a large loss, making $100,000 or losing $100,000— a zero-sum game. The reason for this is that investors are mostly focused on deals or specific assets, rather than portfolio construction. They also generally allocate to very specific buckets such as equities, fixed income, and “alternatives.” —anything that is not equities or fixed income is generally called an alternative, which doesn’t make any sense —instead of focusing on the portfolio’s utility function: i.e., how all the allocations work together.

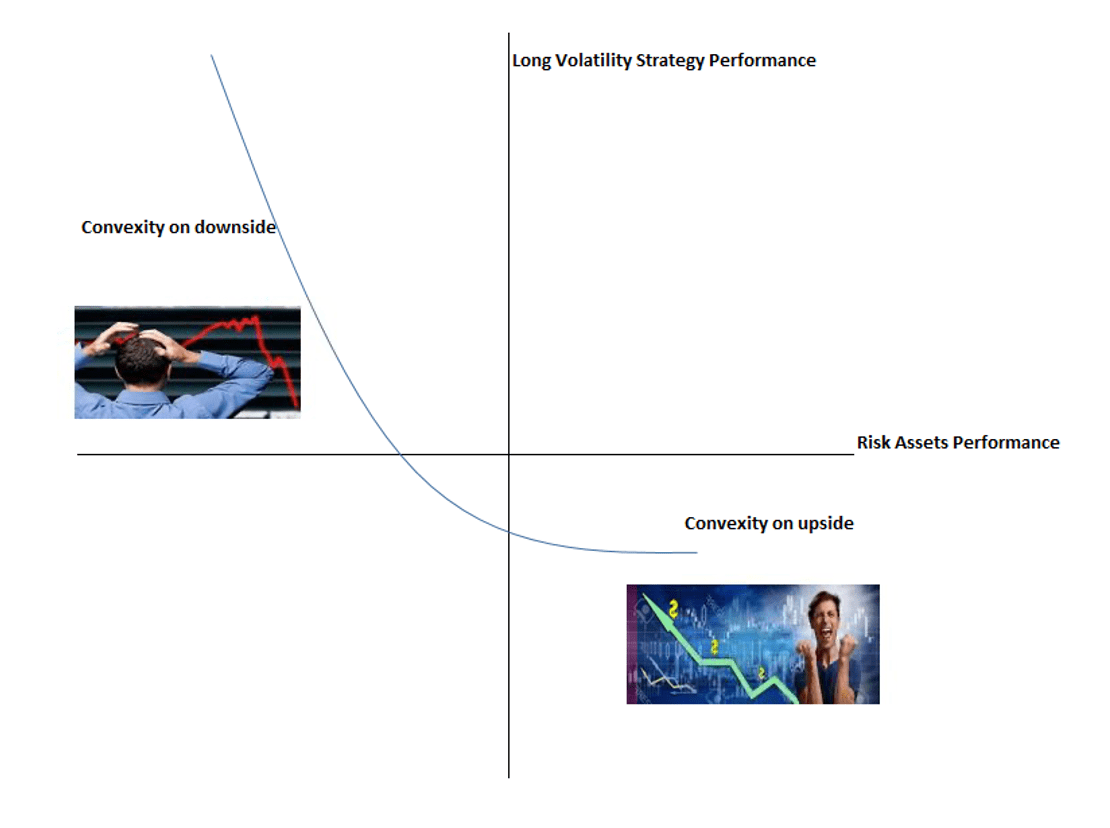

But what if you could bend the two edges of the return profile, preserving most of the upside in up markets, while minimizing the downside in down markets?

THE POSITIVE CONVEXITY SOLUTION

When speaking about convexity, investors usually refer to the nonlinear relationship between a bond and interest rates. Convexity measures the sensitivity of a bond’s duration to changes in yield. A bond with positive convexity will have larger price increases when interest rates decline than price declines when interest rates rise. In our case, we want to create positive convexity in our portfolio.

To achieve positive convexity, we would use strategies that are long volatility, highly convex, and built to respond rapidly to sharp equity market declines, while realizing profits as markets stabilize. These strategies produce liquidity and returns in times of market dislocation. By first addressing the unpredictable, extreme downside, we can put more high-growth, efficient and low-cost risk assets that will benefit us long-term. We can dramatically improve a portfolio’s compounding just by changing the convexity of the portfolio, putting the emphasis on the large numbers, positive and negative.

Having a positively convex portfolio will also relieve you from the need for market timing and listening for predictions, views on certain sectors, and stock picking.

But, do advisors ever discuss such strategies? It is much harder to tell investors, “See what a terrible outcome I avoided?” than to say, “See how high the returns I made you are?” In fact, I have never heard a wealth manager or a fund manager mention anything like this in a conversation.

WHY AM I SAYING THAT RISKS ARE HIGHER TODAY?

I have written on the topic of risk often in the last few years. I believe it is the most important aspect to consider when managing investments. Legendary investor Benjamin Graham said, “The essence of investment management is the management of risks, not the management of returns.”

Risks are higher since the number of potential extreme events and their sources (economic, political and so on) have increased significantly. It is not because I see a specific event that would cause markets to fall. I have no idea if and when such events will happen. However, looking historically, there are more negative events that could happen today that would cause markets to fall than in the past. It means that uncertainty is growing, but not yet priced into markets.

As Professor Elroy Dimson said, “Risk means more things can happen than will happen.” (I had the pleasure of meeting Professor Dimson at the Yale School of Management where we had a nice discussion about Israel over lunch.)

As a matter of fact, the only thing we are sure of is that extreme events (good or bad) are never priced in markets. By definition, a tail event or a “black swan” event can’t be predicted by markets. And because a tail is not in the cards, it is usually rather cheap to protect against it with a small percentage of your portfolio. In my view, the most efficient way to protect against extreme events is through dedicated, long volatility strategies.

Click here to download the PDF.