Omnia Observations: Turbulent Times And Silver Linings

By Alon Ozer, Chief Investment Officer and Lawrence Muscant, Senior Advisor to the Firm

With the S&P 500 index down over 20% year-to-date, by one definition, we have officially entered bear market territory. At the same time, the bond market, once a faithful fixed income allocation to balance equities risk, is also in a freefall. Today, many investors are wondering (with good reason) where, if anywhere, to deploy capital and mitigate their losses. To begin answering this important question, it is helpful to better understand how we got here.

By March 2020, the drastic effects of COVID-19 set in motion some of the early conditions for this historic economic challenge. It is well documented that as COVID wreaked havoc on both the domestic and global economy, businesses were forced to scale down or close operations due to both labor shortages and fractured supply chains. At the same time, equity markets began shutting down and falling apart.

To provide short-term relief from the subsequent impacts of economic shutdown, central banks around the world reacted in an unprecedented manner by injecting trillions of dollars of liquidity into markets and into people’s hands. This resulted in an immediate, massive rise in the demand for goods, services and financial assets, a demand that the supply side – due in part to our fractured supply chains – was in no condition to meet and is still struggling to meet even two years later. This major distortion between elevated demand and diminished supply led to a level of inflation unseen in nearly 50 years and extreme valuations in many financial assets. As recently as last month, US inflation jumped to a 41 year high of 8.6%, leading 70% of American economists expecting the US to tumble into recession as early as 2023.[1]

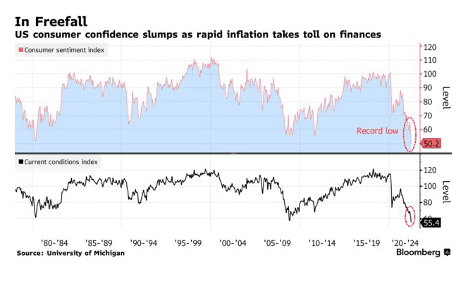

In a desperate attempt to address inflation, the Fed started to aggressively raise interest rates and reduce liquidity within the American markets. The result of this, however, is that consumers are now hurting both from elevated prices and higher interest rates. With both diminished purchasing power and more costly borrowing terms, Americans are choosing to buy less, even if the supply they were looking for just two years ago is beginning to be met.

As the Fed fights inflation with these new deflationary pressures, prices for financial assets are dropping first, with goods and services soon to follow. The American real estate market has already seen a 5-10% downward shift, according to David L. Steinbach, global chief investment officer at Hines,[2] and the global bond market is tumbling quickly.

In the 1970s, after years of high inflation, Paul Volker dramatically raised interest rates and sent the economy into a severe depression. Unfortunately, our economy today is much more fragile than it has been in the past. Given the US’s massive levels of debt, dramatically raising interest rates will make servicing our debt much more expensive and untenable without significantly devaluing the US dollar. Historically, it can take a full year or more for a bear market to resolve itself through a proper equilibrium of supply and demand, and elevated inflation rates prevent the Fed from stepping in and adding short-term liquidity to support the markets. In effect, the Fed’s “good” options are somewhat limited. The only potential action available (which is more of a “less-bad” than “good” option in this case) would be a joint operation between the Fed and the US government.

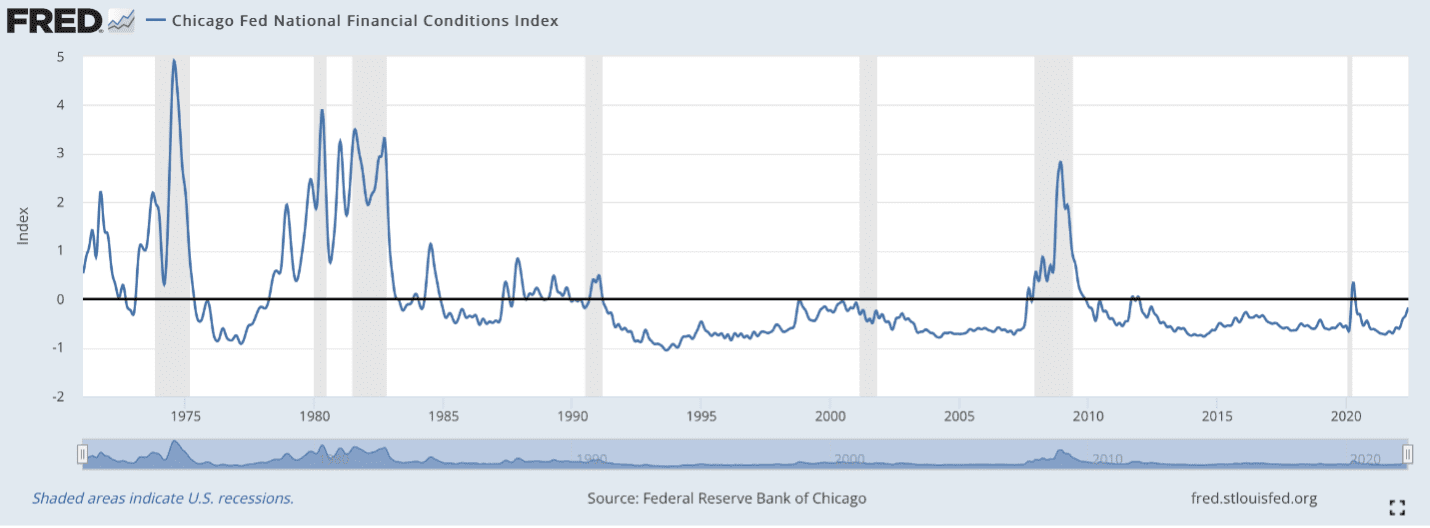

Recession is a critical (and healthy) part of the economic cycle; it is the process where the markets and the economy get rid of excess capacity built over the growth stage. Since we haven’t seen a recession since 2008-2010, excess capacity has been building to astonishing levels (for example, a fifth of public companies are “zombies,” meaning they are unviable and need to borrow money to survive).

Within this economic landscape, investors must take a realistic look at their portfolios, as traditional asset allocations were never built for environments like this. And while investors have benefitted from 40 years of rising equity prices, rising bond prices, low interest rates and low inflation, nothing lasts forever. Rather than merely looking at different asset classes, more attention should be put towards understanding the different economic regimes, the changing relationships between asset classes, and acting accordingly. Those ‘stuck in the mud’ will continue to risk significant losses.

Investors who saw this coming by purchasing commodities to hedge against inflation had likely been somewhat successful, as they purchased at a lower price. Today, however, with the Fed actively trying to destroy demand and lower commodity prices, it is a much riskier play. Instead, investors would be best served to ride this one out by selectively pursuing trend-following strategies that have a history of success in persistent bear markets. As rising interest rates are killing the bond market, for example, investors can look towards private debt tied to floating rates to stabilize their fixed income allocations. Diversifying risks with discretionary macro and volatility strategies would also prepare portfolios for the fast-changing environment. By shifting focus from asset classes to the broader economic environment, investors may find valuable investment opportunities.

It is important to note that while the Fed may not have many good options to choose from, investors are not hamstrung in the same way. Change may not be comfortable, but it is both necessary and inevitable, so the savvy investor should ride the wave rather than fight it. Investors should ignore voices that say otherwise. What has been done in the past will not work today, and they should not allow themselves to be convinced otherwise. “Bear” Bryant is known for having said, “Offense sells tickets, but defense wins championships.” In this market, the Bear got it right.

[1] https://markets.businessinsider.com/news/stocks/us-recession-likely-economists-predict-inflation-energy-prices-fed-rates-2022-6

[2] https://www.bloomberg.com/news/articles/2022-06-13/inflation-triggers-drop-in-property-values-across-us-europe