Rising Interest Rates & Tightened Lending: Understanding The Effects Of The Fed’s Fight Against Inflation

With the sudden collapse of Silicon Valley Bank (SVB) and Signature Bank (SB), many investors are beginning to ask the question of whether we see a rehash of 2008. While the short answer to this question is “no,” as the circumstances are fundamentally different, it is clear that, like in 2008, a bad economic environment is being intensified by fundamental problems in the monetary system. To fight inflation, the Fed is forced to balance its strategy between increasing interest rates and tightening lending. Both scenarios can cause downstream effects on the economy, providing challenges and opportunities for savvy investors. Maintaining a prudent risk management strategy for investments is extremely important and will remain so going forward.

What keeps us up at night is not what we “know” today but rather what we “can’t know for certain” in the future. SVB and other banks recently took heavy losses on their bonds, but what about the unknown exposure of nonfinancial institutions and third parties to credit derivatives? The world saw this latter issue last year after UK pension plans incurred heavy losses in the Gilts derivatives market, prompting the central bank to bail them out.

In January of this year, we wrote about actions taken by the Federal Reserve and what we subsequently called “The Wheelchair Effect.” Over the past week, we have witnessed the consequences outlined in our memo first-hand.

Banks are vulnerable to a highly inverted yield curve, as their business models are based on borrowing short-term and lending long-term. This is why they were not in a hurry to raise the rates on their deposits, as they acted to control the effect of the inversion. However, as the Fed drastically raised interest rates and depositors achieved higher paying, safer investments elsewhere through opportunities such as treasury bills and money market funds, SVB and SB began to lose deposits. At that point, facing an unprepared-for liquidity crisis, they were forced to sell a significant sum of their bonds prematurely to cover the cost of returning cash to clients. In doing so, they realized substantial losses, spooking clients and leading to a run on the banks.

To contain the problem, the Fed responded with the “Bank Term Funding Program” to stabilize the collateral value of bonds and MBS. Banks can now post a bond with an unrealized loss through this program and receive 100 cents on the dollar. The Fed implemented quasi-yield curve control, but only for banks. And while this is a significant step toward protecting the banking industry, it is probably not enough. The evolving crisis of confidence and subsequent liquidity crisis that has emerged doesn’t care about the good intentions of policymakers; it needs immediate reassurance. And markets will put any statement policymakers make to the test.

During last Thursday’s hearing, Senator James Lankford said to Secretary of the Treasury Janet Yellen, “That (flee of deposits) is happening because depositors are concerned about the bank failures that have happened and whether or not other banks could also fail.” As a result, in just the past week, banks have borrowed $300 billion from the Fed (Source: U.S. Federal Reserve, U.S. Department of the Treasury). The Fed and Treasury will have to deal with this problem very soon.

Funding Is Hard to Come By, and Lending Standards Are Tightening

In the last few days, a massive amount of money has flown out of bank deposits and into short-term treasuries and money market funds at a rate comparable to those seen before significant market events. Banks currently hold approximately $2.7 trillion of US treasuries and mortgage-backed securities (Source: U.S. Federal Reserve, U.S. Department of the Treasury). Cash-starving banks used the Fed’s discount window to borrow $300 billion (Source: U.S. Federal Reserve). Moreover, FHLBanks, eleven regionally based wholesale suppliers of lendable funds to financial institutions, issued new debt to raise $307 billion in emergency liquidity as they prepare for a worsening environment (Source: Council of FHLBanks). This reminds us of 2007 when FHLBanks provided short-term emergency liquidity to regional banks that could not access it in the market. If, as much of the evidence suggests, we are heading into an acceleratory monetary funding crisis, liquidity for banks and borrowers is uncertain. Private debt will provide investors with an attractive, risk-mitigating asset in this environment.

The Bond Market Has Been Warning Us

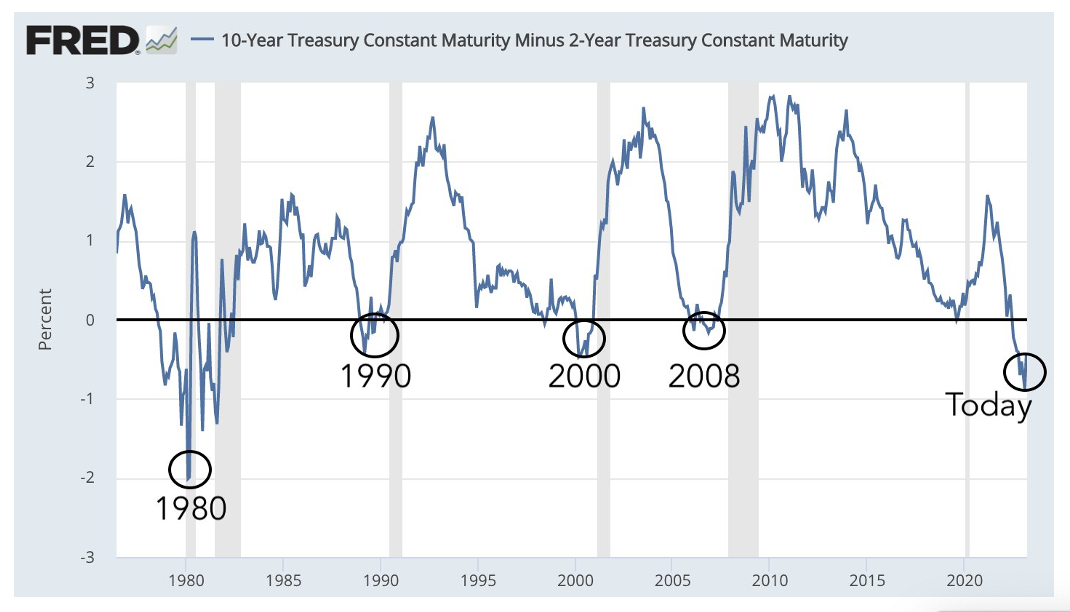

Last week we saw unprecedented moves in short-term treasuries (also in European short-term sovereign debt), causing the yield curve to re-steepen after a record inversion. As previously shared by our Omnia team, the yield curve inverts as it “smells” economic weakness down the road, forcing the Fed to lower rates. The curve then re-steepens when investors realize that the event is upon us and rush to buy safe assets (to post as collateral), causing short-term yields to plummet. As opposed to a good yield curve steepening where long rates rise higher than the short end, this results in a seriously bad steepening, as reflected in the chart below.

Source: FRED (Federal Reserve Economic Data), Federal Reserve Bank of St. Louis

Strategic investing requires a robust process; you’re gambling if you don’t have one. A stable process insulates you from overreaction to market events and helps you plan to “pull the trigger” when the time is right rather than when you fear you “have to.”

At Omnia, our asset allocation is guided by macro factors, not a fixed proportion of asset classes. With no “fixed” allocation, we must hold and follow; we can move across assets according to our investment methodology and research. This allows us to be flexible when necessary while staying true to our plan. It is why our portfolios performed exceptionally well in 2022 and are well-positioned for the days and months ahead.

This approach has allowed us to avoid long-duration assets for the better part of two years. Rising inflation and rates made these assets less desirable and opened the door for other, more desirable asset opportunities. Our plan places risk management as its priority.

We are holding our lowest equity allocation, as we saw better opportunities with a higher probability of profits and lower risk in other assets.

We have increased our tactical allocation to take advantage of the short-to-intermediate term dislocations we expect to see in assets while reducing cross-correlations in the portfolio.

Our hedge funds allocation is well diversified across low-beta strategies such as fixed income arbitrage, volatility and statistical arbitrage, and market neutral. This “stand-alone” allocation helps us generate returns uncorrelated to equities or fixed-income markets.

On the debt side, we have been focusing on high-quality private debt. Many corporations raised significant capital in the last few years, which should help them withstand a potential recessionary environment. Corporate floating rate debt had been a beneficiary in this environment.

Despite incidents of increased volatility all around us, we strive to turn challenging times into opportunities.

All is according to our plan.

Click here to download the PDF.