Reading Between the Lines of the Fed and Treasury Actions

At the end of 2018, we wrote about our view of the long-term debt cycle and how historically it played out. We wrote that at a certain point, monetary policies are not sufficient or effective, especially once interest rates hit zero and there’s a need for fiscal policy as well. This moment arrived in March 2020 (the timeline was accelerated by the Covid-19 pandemic), where the Fed dropped interest rates to zero, and at the same time, the government injected money into the economy through different programs.

Where are monetary and fiscal policies heading from here? To get a better understanding of the possibilities, we should look at what the Fed and Treasury have been doing and what the capital markets are telling us.

Action from the Fed and Treasury

Establishing a Standing Repurchase Agreement (REPO) Facility

I wrote about the overnight reverse repo facility and the new standing repo facility in our memos: The Fed’s Liquidity Conundrum and Short-Term Rates Dilemma, and It’s Never a Bad Time to Be Prepared. Especially Today. In the last couple of years, we saw disruption to the normal functionality of the Treasury market, and the Fed had to intervene through the repo market to stabilize the financial markets. The worst happened during March 2020 when liquidity in many Treasuries disappeared. But why establish a standing/permanent facility? Does the Fed expect additional disruptions?

Reducing Sales of Long-Term Debt

This announcement by the U.S. Treasury surprised me. Normally, it’s not unusual for the Treasury to change debt maturities auctions, but with historically low intertest rates, potentially increasing due to inflation, why would the Treasury choose to cut sales of long-term debt? It just doesn’t make any sense. Oddly enough, this announcement by the Treasury came a few hours after the Fed announced it will be buying less Treasuries. One reason for such a move could be that the Treasury is struggling to rebuild its cash balance, and trimming coupon barring long-term debt will allow the Treasury to issue more short-term debt/bills. But I believe there’s more to that.

What Have the Markets Been Telling Us?

At the same time the Fed and Treasury have been preparing for the day after tapering, the Treasury market has been giving us additional signals.

The Treasury Market Liquidity

On December 6, Bloomberg reported that buying and selling large quantities of Treasuries without creating significant moves in the market is the hardest it’s been since March 2020.

To remind you, the Fed reduced its monthly $120 billion bond purchases in November by only $15 billion (in December it increased to $30 billion). It didn’t take long for the market to tell us something is off.

Inflation and Bond Markets

October inflation readings were very high historically. Fuel oil prices soared 12.3% for the month, part of a 59.1% increase over the past year. Energy prices overall rose 4.8% in October and are up 30% for the 12-month period. Used vehicle prices again were a big contributor, rising 2.5% in the month and 26.4% for the year. New vehicle prices were up 1.4% and 9.8%, respectively. This trend continued in November where about half of the growth in headline inflation is contributed to rises in car and energy prices.

On November 30, Fed Chair Jerome Powell said during a congressional hearing, “I think it’s probably a good time to retire [the word “transitory”] and try to explain more clearly what we mean.”

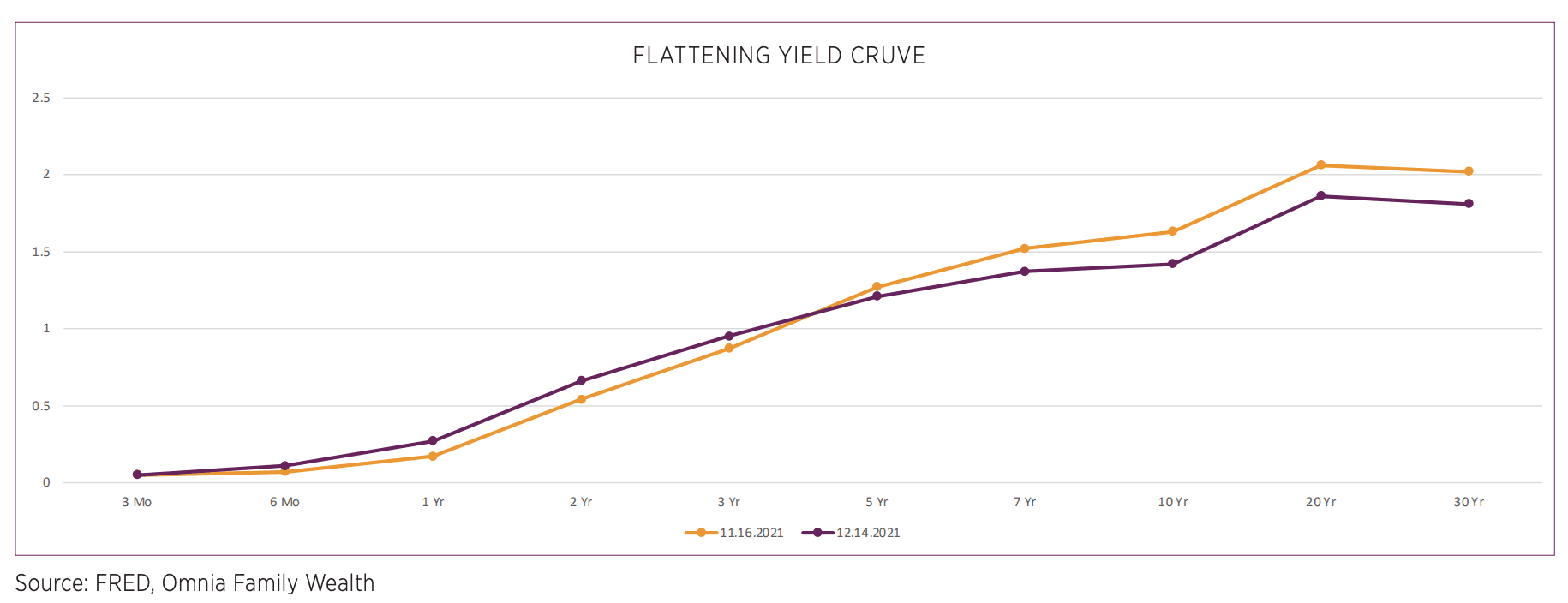

The bond market reacted to the Fed’s comments with a significant move. It might not seem like a lot, but this is the largest move since 2011. The market wanted to send a signal. Short-term rates are rising fast and strong (price is lower). The 5-year note is about to have its worst year since 1994 and the 2-year note is about to have its first losing year ever! After the statement, markets have priced three rate hikes in 2022.

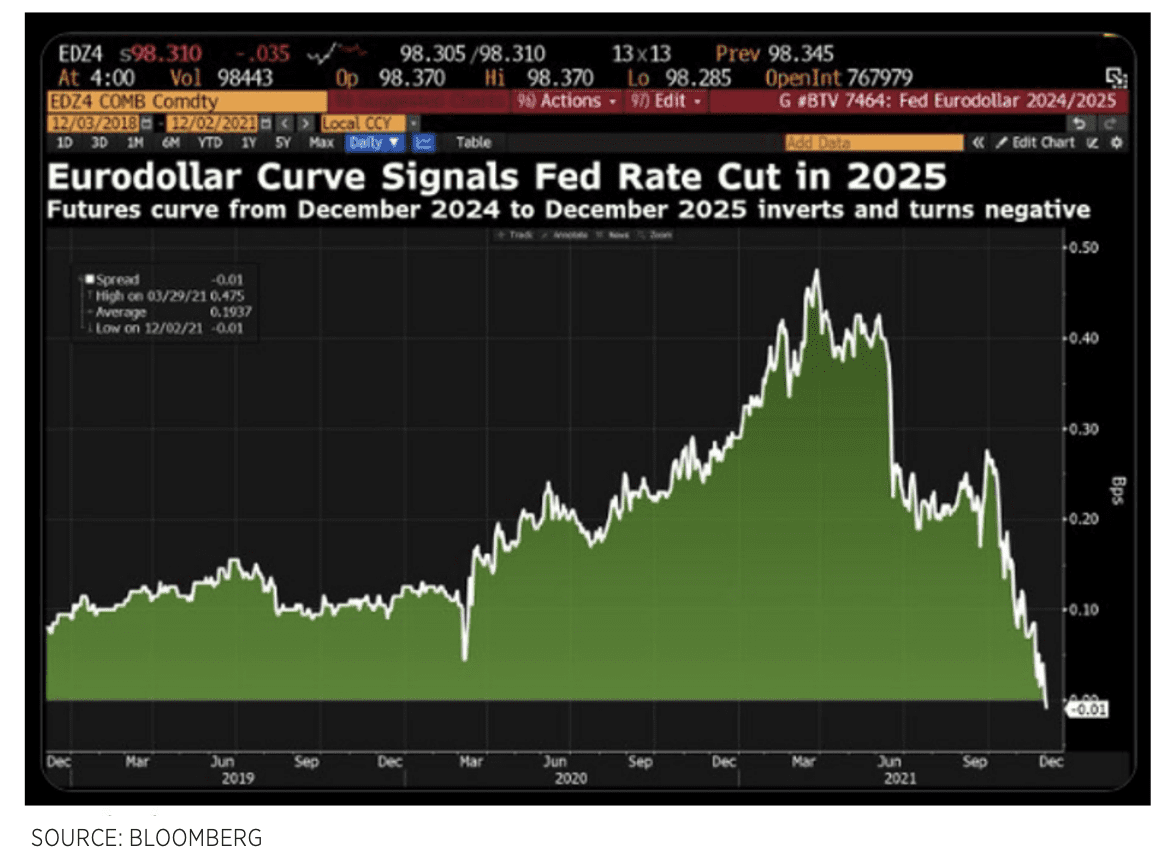

At the same time, the Eurodollar yield curve, which we consider to be very reliable, has reacted as well, and actually inverted (as it did in 2006 and 2018) at the 2025 point. The front end of the curve reflects the “hawkish” policy of coming rate hikes. But the long end reflects the market’s view of the next few years and signals deflationary risks.

Then, on the Fed’s December 15 meeting, Jerome Powell went even further, and announced the Fed will be cutting back more quickly on its pandemic-era stimulus and shift the policy to include possible higher interest rates in 2022.

Market actions are telling us the market is rejecting the idea of higher interest rates!

We believe Jerome Powell’s recent statements are hawkish — it doesn’t mean he is expecting long-term, growing inflation pressures. If fact, Powell also said, “Baseline expectations is that inflation will move back down over the course of next year.” I believe the problem is that Powell is under significant political pressures to deal with inflation even though he still sees it as transitory. President Biden is being blamed for the high inflation (as we can see in his approval rating, which fell significantly in the last couple of months) and he needs to show he will be fighting it.

This is a recipe for a bad policy mistake.

Conclusion

As I wrote in the past, I do not think the Fed has the ability to completely withdraw its support from the financial markets (without causing significant stress in the markets). The two actions by the Fed and the Treasury lead me to believe that the Fed and Treasury are preparing for the day after tapering (and market reactions are confirming their concerns). In other words, I believe the Fed will keep monetizing US short-term debt and deficit through its standing repo facility.

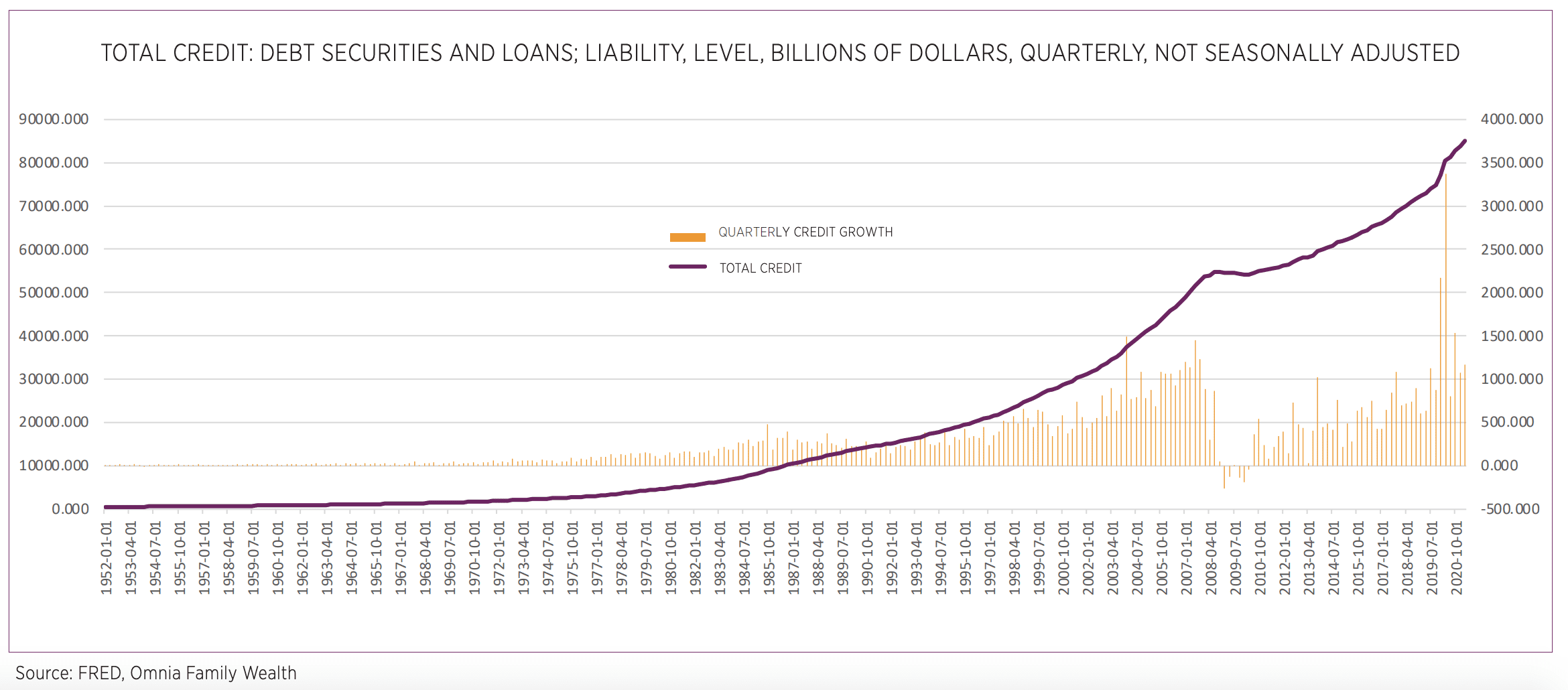

One Fact on Credit Growth

This point is ignored by many investors, but it is very important to understand. Since 1952, every time credit growth in the US (adjusted for inflation) was less than 2%, the economy fell into recession. So, with current inflation, credit growth will have to be over 7% just to keep the economy out of recession. In the second quarter of 2020, credit (year over year) grew by 9.9% but in the second quarter of 2021 it grew by only 0.9%. To put it into perspective. If total credit is $85 trillion, credit will have to grow by $5.95 trillion. It is a factor the Fed will have to consider as well.

Click here to download the article.

Omnia Family Wealth, LLC (“Omnia”), a multi-family office, is a registered investment advisor with the SEC. This commentary is provided for educational and informational purposes only. It does not take into account any investor’s particular investment objectives, strategies, tax status, or investment horizon. No portion of any statement included herein is to be construed as a solicitation to the rendering of personalized investment advice nor an offer to buy or sell a security through this communication. Consult with an accountant or attorney regarding individual tax or legal advice.

Advisory services are only offered to clients or prospective clients where Omnia Family Wealth and its representatives are properly licensed or exempt from licensure. Information in this message is for the intended recipient[s] only. Please visit our website https://omniawealth.com for important disclosures.

This content is provided for informational purposes only and is not intended as a recommendation to invest in any particular asset class or strategy or as a promise of future performance. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve.

The views expressed herein are the view of Omnia only through the date of this report and are subject to change based on market or other conditions. All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. Omnia has not conducted an independent verification of the data. The information herein may include inaccuracies or typographical errors. Due to various factors, including the inherent possibility of human or mechanical error, the accuracy, completeness, timeliness and correct sequencing of such information and the results obtained from its use are not guaranteed by Omnia. No representation, warranty, or undertaking, express or implied, is given as to the accuracy or completeness of the information or opinions contained in this report. This report is not an advertisement. It is being distributed for informational and discussion purposes only. Omnia shall not be responsible for investment decisions, damages, or other losses resulting from the use of the information. This report is not intended for public use or distribution. The information contained herein is confidential commercial or financial information, the disclosure of which would cause substantial competitive harm to you, Omnia, or the person or entity from whom the information was obtained, and may not be disclosed except as required by applicable law.

Statements that are non-factual in nature, including opinions, projections, and estimates, assume certain economic conditions and industry developments and constitute only current opinions that are subject to change without notice. Further, all information, including opinions and facts expressed herein are current as of the date appearing in this report and is subject to change without notice. Unless otherwise indicated, dates indicated by the name of a month and a year are the end of the month.