Omnia Observations: The United States vs. Oil and the Changing Macro Fundamentals

The world monetary system–by which I mean the dollar system, where most of the world’s trade is done through the artery of global liquidity–has gotten much more complicated and fragile over the last two decades. In the 2008 financial crisis, the financial system broke down and was bailed out by central banks. Today, the system is challenged again for different reasons. Recent events increased the probability of changes and fragmentation in our existing monetary system. We may very well see changes in the way countries trade with each other, how central banks invest their reserves and an end of existing trading agreements leading to the formation of new ones. “There are decades where nothing happens; and there are weeks where decades happen.” – Unknown

THE BRETTON WOODS AGREEMENT – A NEW FINANCIAL SYSTEM

During WWII, the financial situation of the U.S. had improved dramatically compared to the other fighting nations. Toward the end of the war, in 1944, the U.S. held most of the world’s gold reserves, as the world was buying weapons and other supplies from the U.S. during the war. The pound sterling, which dominated world trade prior to the war, had weakened materially and the U.S. dollar was ready to step in as the global reserve currency. Once the war subsided, both Britain and the U.S. looked to create a new monetary system, and after much negotiation, the Bretton Woods Agreement was finalized.

In fact, until the war, oil contracts have been quoted in terms of gold or pounds sterling. After the war, the U.S. and British governments were looking to create a new monetary system. Obviously, each offered a system that would benefit themselves. The U.S. suggested the White plan, and Britain suggested the Keynes plan. The U.S. plan prevailed.

The Bretton Woods agreement had a few main features:

- The U.S. dollar would be pegged to the price of gold at a price of $35 an ounce.

- All other currencies would be pegged to the U.S. dollar; thus, countries would settle their international balances in U.S. dollars.

- The exchange rate between the U.S. dollar and other currencies will fluctuate within 1% on the basis of legal exchange rates.

- The U.S. dollar will serve as the reserve currency.

In effect, this system guaranteed there would always be demand for the U.S. dollar and, for that, demand for U.S. debt.

The Breakdown Of The Bretton Woods Agreement

By the 1960s, as the European and Japanese economies recovered and their exports became more desired and competitive, the need to hold U.S. dollars had decreased, as these countries were being paid in dollars for their exports to the U.S. For this reason, trading nations started converting their dollars back to gold. (The U.S. had to ship them the gold). At the same time, the U.S. was also funding a very expensive war in Vietnam. As the U.S. balance of payments deteriorated, the risk of a “run on gold” and the ability for the U.S. to meet its financial obligations had increased materially. In addition, starting in 1965, the U.S. experienced growing inflation pressures. On August 15, 1971, President Nixon announced the close of the gold window. From then on, trading partners of the U.S. were no longer able to convert their dollars to gold. The breakdown of Bretton Woods created turmoil in world currency markets, and between 1971 and 1973, the U.S. dollar fell by 25% on average relative to other major currencies. One thing was clear: In order to maintain a world reserve currency, one needs to keep running (and enjoying) a trade deficit, providing dollars to the world. To do that, one needs to guarantee a constant demand for dollars.

The Petrodollars system

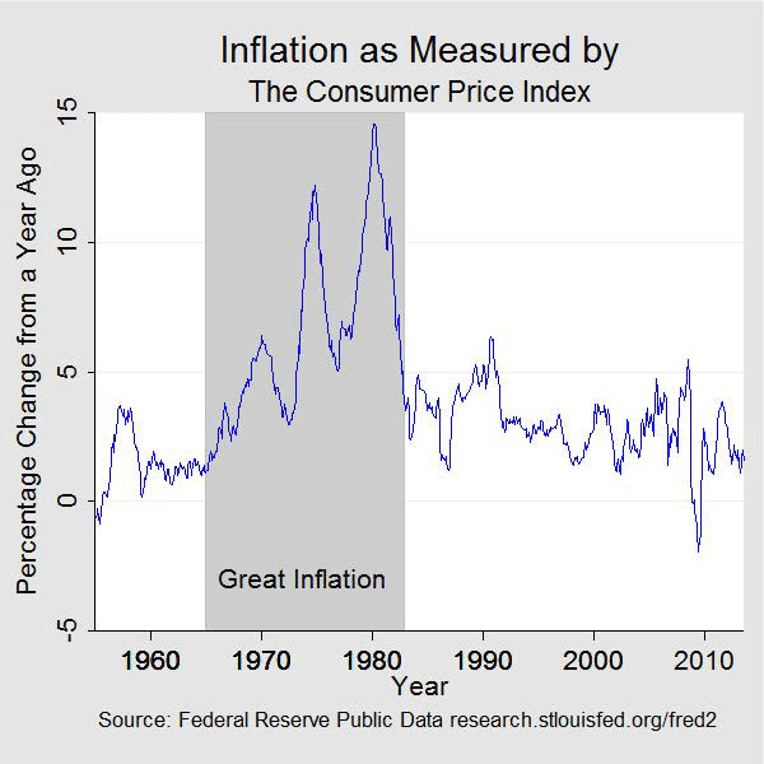

In addition to the chaos created by the termination of the Bretton Woods agreement, October 1973 brought us an oil crisis. In retaliation for supporting Israel in the Yom Kippur War, OPEC countries led by Saudi Arabia forced an oil embargo on the U.S. and Europe. Oil prices quadrupled, inflation hit 11%, and the S&P 500 was down -30% (following an 11% drop in 1973). The economy was in a downward spiral.

On June 8, 1974, Secretary of State Henry Kissinger and Saudi Prince Fahd signed an agreement for economic and military cooperation between the two states.

The two most important points for the U.S. in this agreement were:

- Oil will be priced and invoiced in U.S. dollars.

- The proceeds from the sale of oil will be invested in U.S. treasuries or other dollar-denominated securities.

The objectives that were achieved were:

- To neutralize oil as a weapon.

- To create a constant, reliable demand for U.S. dollars.

- Ensure that dollars would be recycled back into U.S. debt to fund the growing deficit.

Let us think about the importance of this achievement. The largest commodity in the world, which had no alternative, was now priced in U.S. dollars. Any country that wanted to import oil from OPEC states would first need to convert its currency into the U.S. dollar.

Is The U.S. Dollar Backed by Oil?

While the U.S. dollar is not backed by oil in the same way it was backed by gold up until 1971, oil still plays an important role in the ongoing demand for U.S. dollars. Oil demand at pre-pandemic levels was at 99.5 million barrels a day (IEA Oil market Report, December 2021). The constant demand for energy supports an increasing demand for U.S. dollars, allowing the U.S. to run massive deficits. Other countries must maintain large dollar reserves to protect themselves against a rising dollar/devaluation against the dollar. However, this is no longer a safety net we can rely on.

FAST FORWARD TO TODAY

The war in Ukraine, in addition to being a humanitarian catastrophe, also highlights three major points with immense implications:

- Reshoring Supply Chains

This trend had begun during the tough months of the Covid-19 pandemic, as countries suddenly realized how much they depended on other states for critical components and materials. Read more: See full DOD report Securing Defense-Critical Supply Chains. To me, a longer-term supply chain migration out of China for U.S. and European companies seems inevitable. The pace and size are still to be determined. Japan has already started incentivizing domestic manufacturing. The deglobalization trend is real, but its implications, economically and geopolitically, are still unknown. More about that later. Read more: Japan Boosts Incentives to Counter China’s Factory Dominance

- Safety of Reserve Assets

On February 26, 2022, the Russian central bank lost access to its reserves, valued at $630 billion, which pushed Russia toward a potential default on its debt. In addition, major Russian banks were denied access to the SWIFT network. Read more: U.S. escalates sanctions with a freeze on Russian central bank assets. Central Banks around the globe keep their reserves in developed countries, mostly in Europe and the United States. As a sovereign country with a capital account surplus, you now must rethink how you should save and invest these reserves, where and in what assets. How will you be sure they are protected against sanctions?

- Oil Trade in Currencies Other the U.S. Dollars

Over the last few years, major countries expressed their dissatisfaction with the need to convert their currencies to dollars in order to purchase oil. Since the war in Ukraine broke out, these voices got much louder. Read more:- Saudi Arabia Considers Accepting Yuan Instead of Dollars for Chinese Oil Sales.

- China Is Reportedly Taking the First Steps to Pay For Oil In Yuan Instead Of U.S. Dollars This Year.

- Putin Tells Europe: Pay in Rubles or We’ll Cut Off Your Gas.

- Russia, China Agree 30-Year Gas Deal Via New Pipeline, To Settle in Euros

- As West Shuns Moscow, Officials Say India Eyes More Cheap Russian Oil

WHERE DO THESE POINTS COLLIDE?

Because most of the world’s trade is done in U.S. dollars (especially in energy), countries must hold reserves in U.S. dollars. But, by holding reserves in U.S. dollars, states expose themselves to sanctions and confiscation of their reserves in times of conflict with the U.S.

In a seeming response to the U.S. and Europe blocking Russia’s access to its reserves, China increased pressure on Saudi Arabia to receive yuan for their purchase of oil. This request cannot be ignored as China consumes 25% of Saudi Arabia’s annual production. China is also by far the largest oil importer in the world. We should expect other countries to follow and for China to push for other commodities to be bought in yuan. There’s also the possibility that we will see countries deploy some of their reserves into other hard assets and commodities. The sanctions on Russia also gave China the legitimacy to push its Cross-Border Interbank Payment System as a replacement for the SWIFT system.

How Could This Affect the Dollar and the U.S?

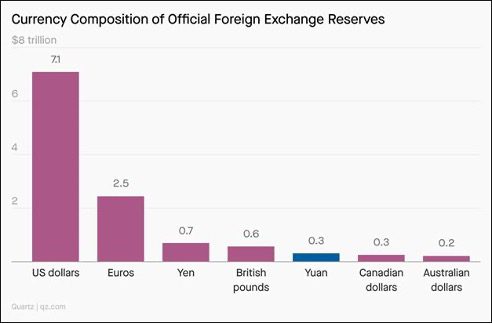

Let me start by saying that the U.S. dollar is not about to be replaced by anything else anytime soon, as there’s no valid alternative and our capital markets are the main liquidity vain for the largest companies on earth. After WWII, England was left with a deficit that was hard to maintain and the pound sterling was losing value. At a point, England had to suspend the pound’s convertibility, but it took another 20 years for the pound to officially lose its status as a reserve currency. In the table below, you will see the importance of the U.S. dollar to world trade.

Source: IMF

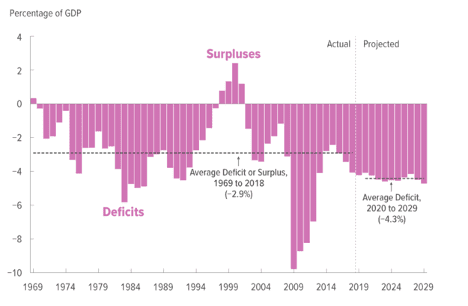

Putting all the points I mentioned above together, the picture is very concerning. Point #1 is inflationary and a long and very costly process. The process of improving supply chain resilience and protection against material shortages, as the DOD has recently suggested, will cost trillions. Read more: Biden’s $5.8 Trillion Budget Pivots Toward Economic and Security Concerns. To fund these projects, the Treasury Department will have to massively increase the issuance of treasuries at a time when the Fed, which has been the largest buyer of treasuries, is planning on reducing its holdings of treasuries. Read more: Fed Lays Out Plan to Prune Balance Sheet by $1.1 Trillion a Year. This will increase an already massive deficit and add pressure on already rising interest rates.

Source: Congressional Budget Office

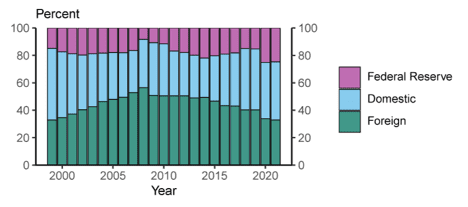

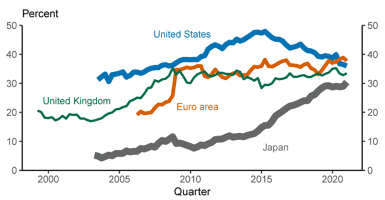

Points #2 and #3 mean less dollar demand and fewer buyers of treasuries. (This adds to an existing situation of foreign investors holding fewer treasuries, as you can see from the charts below). Adding this to point #1, it’s the perfect storm.

If we didn’t have such a huge deficit, I would say there’s no reason to be concerned, but we do. I don’t think many investors understand how bad our fiscal situation is. It is so bad that in the next recession, there’s a possibility that tax receipts will not be enough to cover our debt servicing and entitlements payments. The potential impact will be higher rates on U.S. debt, which will be financed through higher taxes, spending cuts (which I doubt will ever happen), and the Fed printing money. This, in turn, could push the U.S. into a recession or, worse, stagflation.

HOLDINGS OF MARKETABLE U.S. TREASURIES:

Source: Federal Reserve

SHARE OF GENERAL GOVERNMENT DEBT SECURITIES HELD BY FOREIGN INVESTORS:

Source: Federal Reserve

Other Implications

The U.S. dollar is the most important asset in the world today. The flow of dollars is crucial for global funding and trade and affects the behavior of different asset classes. The dollar’s relation to other currencies (specifically the Japanese Yen) affects liquidity in major markets. A change in the strength and role of the dollar could affect the relationship and correlation between assets. We should expect to see macro fundamentals changing that would force investors to rethink their investment strategies.

A Note About Digital Assets

I believe this will also give another push to the decentralization finance trend where no one country will have the control of a reserve currency. The support in Asia and third world countries where financing costs are very high will be strong. I believe other developed countries will benefit as well. The U.S will be the main opponent. This process, if it happens, will take years, but it’s important to keep watching the developments.