A Total Disconnect

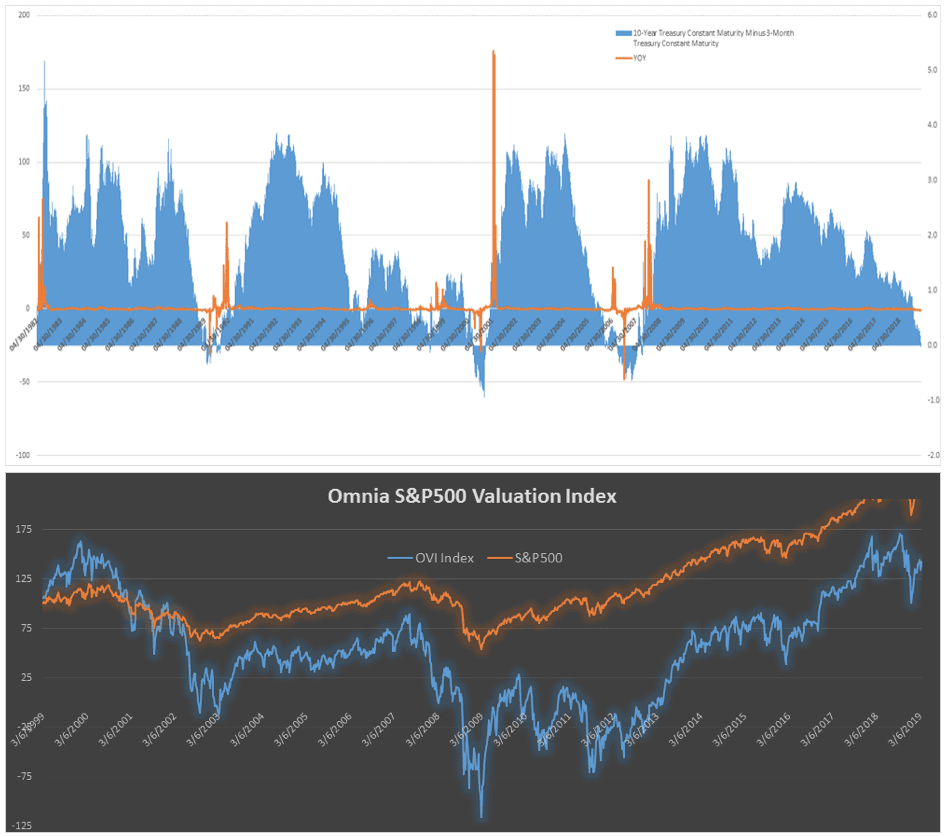

There’s a clear disconnect between the US equity market and the bond market. Both interpret the Fed’s recent comments very differently.

Equity markets are happy and hopeful for more stimulus to come, no more balance sheet reduction and maybe rate cuts ahead. The party can continue! The bond market on the other hand is sending a warning signal. If we need more stimulus, the economy is probably not as strong as investors think, and a slowdown could be much worse than what investors expect.

So, who’s right? We think it doesn’t really matter…

When equity valuations are very high and yields are collapsing all over the place, both in the US and in France, in Germany where the 10-year Bund yields are at negative territory, and in Japan where the 10-year is actually lower than the Bund’s, it is time to take risk off the table. The risk reward is not in your favor. No bull market started from an inverted yield curve.

Important Information

The information provided is for educational and informational purposes only and does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. You should consult your attorney or tax advisor.

Omnia Family Wealth LLC (“Omnia”) is a registered investment advisor. Advisory services are only offered to clients or prospective clients where Omnia and its representatives are properly licensed or exempt from licensure.

Risk Disclosure

No investment strategy or risk management technique can guarantee returns or eliminate risk in any market environment.

All investments include a risk of loss that clients should be prepared to bear. The principal risks of Omnia strategies are disclosed in the publicly available Form ADV Part 2A.