Navigating an Uncertain Future

That there is palpable uncertainty in both the American and global economies should not be news for any attentive investor. The anticipated post-COVID recovery boom has been quickly overshadowed by geopolitical crises, uncertainty in our critical supply chains, rising interest rates and a continued surge of inflation. The fertile ground for economic growth that many investors were hoping for is still uncomfortably rocky.

In wake of this, investors inspired by the adage “buy low, sell high,” can find themselves tempted to move from safe, long-term sustainable investments, into more aggressive, and potentially unfounded, high-yield opportunities. And while there is assumed security in the belief that everyone makes money in an “up market,” smart investors need to be wary of those that promise outsized returns without sufficient logical justification for them. Moreover, savvy investors would be well served by focusing on how well their portfolios are positioned for potential downturns. To put it in baseball terms, the best hitters in the game all have the power to hit 40 home runs a year. However, what separates the Hall of Fame player from someone struggling around the Mendoza line, is knowing when to lay off a pitch, and when to swing for the fences.

According to American financial historian, economist, and educator Peter L. Bernstein, “The essence of risk management lies in maximizing the areas where we have some control over the outcome while minimizing the areas where we have absolutely no control over the outcome.”[1] It is through this approach to risk mitigation that well-designed portfolios protect investors from extreme market conditions. Rather than push investors to shoot for “the big score,” methodology-driven, diversified, and carefully invested portfolios are built to safely grow wealth regardless of the economic environment, while providing protection from random events that can have devastating impacts. Gamblers rarely hit the jackpot and treating portfolios like a unique stock or speculative fund is akin to treating a lottery ticket like an investment plan, no matter how lucrative the forecasts may appear to be.

In fact, however enticing they may be, forecasts should be no more than one factor in reviewing investment opportunities. Canadian American economist, diplomat, and public official John Kenneth Galbraith perhaps stated it too bluntly when he wrote “we have two kinds of forecasters, those who don’t know, and those who don’t know they don’t know.”[2] The truth is none of us have crystal balls that would enable us to accurately and consistently “time” the market. If we did, we would always know today where to best put our money tomorrow. So would everyone else, which would negate outsized returns for all involved. Smart investors, however, do conduct extensive research to best assess the probabilities that may lie ahead.

Perhaps the only economic certainty that we know is that markets run in cycles, and that by attuning oneself to its movement within these cycles, there is opportunity to maximize investment returns. When making this case in his book, “Mastering the Market Cycle: Getting the Odds on Your Side,” Howard Marks notes that the odds for growth change “as our position in the cycle changes. If we do not change our investment stance as these things change, we’re being passive regarding cycles; in other words, we’re ignoring the chance to tilt the odds in our favor.”[3] For Marks, and others, such as Ray Dalio, no one sitting at the blackjack table knows for certain what cards they will be dealt. But, if they are careful in following the trajectory of the game, they should be able to pick up when the deck is hot and maximize their bets when it is favourable. On the investment side, those with a firm grasp of both quantitative and qualitative indicators can help gauge where we are in the cycle and offer opportune times and strategies for taking advantage of current positions.

Omnia’s investment methodology leverages both streams of data to mitigate and respond to uncertainty and risk through a disciplined, systematic, rules-based and repeatable approach. In fact, “without some sort of strategy based on information, decision makers and investors are like captains of a ship, navigating in a foggy ocean with changing currents and winds, sailing without instruments, towards an uncertain destination.”[4] Because most important market events are unpredictable, one shouldn’t gamble by trying to “time the market”. Instead, Omnia’s team applies research-based risk assessment and management at each stage of our decision-making process. We leverage fundamentals and valuations, applying this collective knowledge to produce alpha while mitigating risk.

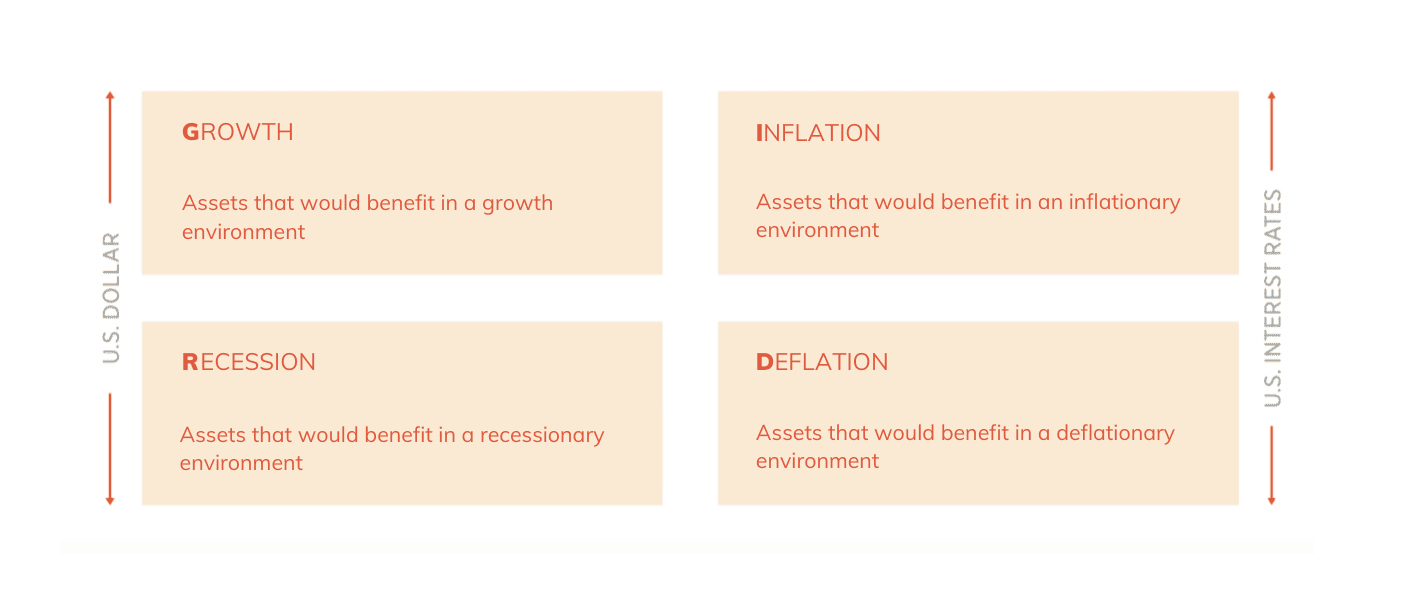

Exceptionally large moves in the markets can take years to develop and can only be identified using a strategic process. At Omnia, our process starts by recognizing that at any point in time, the economy will be either in or transitioning out of one of four dominant economic environments: Growth, Recession, Inflation or Deflation (G.R.I.D.). Because different assets perform well or poorly in different economic environments, we use the G.R.I.D. framework, as well as the directions of interest rates and the value of the U.S. dollar, to shape portfolios that are properly diversified across all potential asset classes. This allows us the flexibility to allocate assets based on their correlation to an economic environment, not based on their correlation to other assets.

For example, in a deflationary environment, very few assets tend to perform well, so our approach would focus on allocations to long-term Treasuries, cash, and other alternative strategies that would benefit from deflationary pressures. However, in a growth environment, where US equities typically perform well, we would focus our allocation accordingly by reducing or completely removing investments such as high yield bonds and commodities. In inflationary times, commodities, real estate, and allocations to emerging markets can perform well. During recession one might best look to investments in private debt and through targeted hedge funds designed to perform well during these environments. Smart investors determine where we are in the environments listed above and weight their allocations accordingly, across all G.R.I.D. quadrants.

Take for example the extreme events that began transpiring in early 2020. 2019 had been a great year, where investment grade bonds were up approximately 17%, commodities were up almost 12%, and the S&P 500 was up over 30%. As Covid-19 began spreading throughout the globe, markets moved rapidly from a state of growth to a state of deflation where all major asset prices began falling sharply. In March 2020, investment grade bonds dropped over 6%, commodities dropped over 16%, and the S&P 500 fell an additional 12% after falling over 8% the month before. As a response to this crisis, central banks around the globe engaged in massive quantitative easing by buying assets and injecting liquidity into the markets. As a result, most assets moved back to a ‘growth mode’ and we saw rapid rises in prices. Within less than a year, we then saw signs of inflation on the horizon. By the first quarter of 2022, inflation was hitting levels not seen since the 1970’s. To sum up, since 2019 the economy went from growth, to deflation, to growth again, and now to high inflation. Because (as we mentioned above), different assets perform better/worse in different economic environments, traditional asset allocations would not have been able to capture these rapid moves of prices on both the up and down sides. This is why strategically-weighted allocation across all environments provides a superior methodology over the long run.

In essence, while others gamble indiscriminately and hope to get lucky, we always attempt to tilt the odds in our favor, and then make strategic investments. And through our strong commitment to diversification, we are always “diversified enough to survive tough times or bad luck so that skill and good process can have the chance to pay off over the long term.”[5]

In an economic period like the one we are currently in, the uncertainty can often be daunting, and can lead to investors making either rash decisions, or no decisions at all. However, if the investor’s portfolio has been crafted and curated properly, not only will they be adequately insulated from risk, but also be in the best position to take advantage of the opportunities available for stable and consistent growth. And with a respectful commitment to proper risk management, investors can consistently see superior returns in the long run.

[1] Peter L Bernstein Peter L. Bernstein (2012). “Against the Gods: The Remarkable Story of Risk,” p.239, John Wiley & Sons

[2] Forecastingquotes — Investment Masters Class (mastersinvest.com)

[3] Howard Marks; Mastering the Market Cycle: Getting the Odds on Your Side, pg. 15.

[4] Carlos Alegria; Economic Cycles, Debt & Demographics; The Underlying Macroeconomic Forces that will Shape the Coming Dec, pg. 18.

[5] Joel Greenblatt ‘The Most Important Things Illuminated: Uncommon Sense for the Thoughtful Investor.