It’s Never a Bad Time to Be Prepared. Especially Today

“You can’t predict; you can prepare” is the name of a memo written by the super investor Howard Marks (which I had the opportunity to meet a couple of times, and he is brilliant) in 2001. This memo was so powerful it helped me shape my thinking on investing and developing my asset allocation methodology over the years. I recommend everyone to read it. I bring this up because, in my opinion, this memo is relevant today more than ever.

I keep hearing from investors that there’s infinite liquidity from the Fed and other central banks, and for that, asset prices will keep rising, and corrections will be short and shallow. I actually agree that the Fed can’t stop injecting liquidity into markets (more on that later), but I have no doubt there will be implications. Think about a car that has a constant supply of gas, you might think it can run forever without stopping, but in reality, other parts in the car will eventually break, either the tires or the engine. I wrote about one side effect of infinite liquidity in a previous memo, The Fed’s Liquidity Conundrum and Short-Term Rates Dilemma. The problem is, we have no idea when the car will break and how bad the damage will be.

So, if we can’t time these events, and their magnitude is unknown, why do I even bother writing these memos? The answer is simple. Even if I can’t predict the timing of an event or its magnitude, it is still extremely valuable to understand the potential or probability of an event and its potential implications. Let’s go back to the car metaphor. Would you go on a family road trip knowing the car tires are worn and there’s a chance one of them will explode at some point? You don’t know if it will happen, and definitely not when, but you know what the potential result of such an event could be! So, I have no doubt you will not take the slightest chance and change tires before your trip. It is exactly the same when managing money; there are some potential events with such implications you just can’t ignore, and while you can’t predict them, you can definitely prepare.

Inflation

The hottest topic in financial media nowadays, inflation is a unique animal that most of us in the wealth management business have never seen or experienced. The last time inflation was a problem in the developed world was in the 1970s. I have read many books about the history of inflation, and I still have many questions. Not to mention, the world is very different than what it was in the 70s. Back then, central banks tried to manipulate and control the economy and the business cycle the same way they do today, and the consequences were horrible. The S&P 500 reached a record high in December 1972 before collapsing 50% until September 1974. Bond investors weren’t lucky either and suffered significant losses as well. The main problem with inflation is that it changes the basic rules of the economy we are used to, and the same is true for the rules of investing.

Whether we get sustained inflation or just transitory, as the Fed is saying, is still hard to know. Bond yields and gold prices are both telling us it is transitory. We also know that some of the rising costs of materials and products are due to the restarting of the economy and dealing with pent-up demand as supply chains broke down during 2020. We also must remember that there are two significant deflationary factors still at work: innovation and demographics. Our research put us in that camp as well. But other things are telling us it might not be transitory. By now, who hasn’t heard that it is almost impossible to find workers (primarily for lower-wage positions) in construction, restaurants, retail, hospitality and others. It has become another pandemic, and a lot of that has to do with the unemployment/stimulus checks and other stimulus programs. In response, we see many companies increase wages to try and attract employees, but once large businesses like the retail chains decide to raise wages, we will have inflationary pressures that are not transitory.

Another risk with inflation is it tends to create geopolitical tensions and historically even wars. The Covid-19 pandemic shook an already troubling situation of cost and accessibility of food worldwide. The last time we saw such an increase in food prices was in 2011, resulting in the Arab Spring, which was more of a bad winter.

I also hear some investors talk about the possibility of hyperinflation. I’m not sure they understand what the meaning, causes and implications of hyperinflation are. Hyperinflation happens when the citizens of a country lose complete confidence in their currency. They will be willing to exchange almost anything they can use and consume just to get rid of their local currency. At that point, you see a breakdown of society and the country as we know it. So, hyperinflation is not a scenario I currently consider.

Whether we get inflation or not is not the question investors should be asking. The right questions to ask are first what type of inflation we could have, as inflation can take many shapes and forms. What will be the implications of a certain level of inflation on my investments and wealth? And can my portfolio withstand, and hopefully benefit from, such a scenario? While we can’t predict inflation, some inflationary scenarios are important to consider as they can make or break your portfolio. Inflation is one of these scenarios a portfolio should always, at least partially, be hedged against.

The Monetary System Is Ever More Complicated

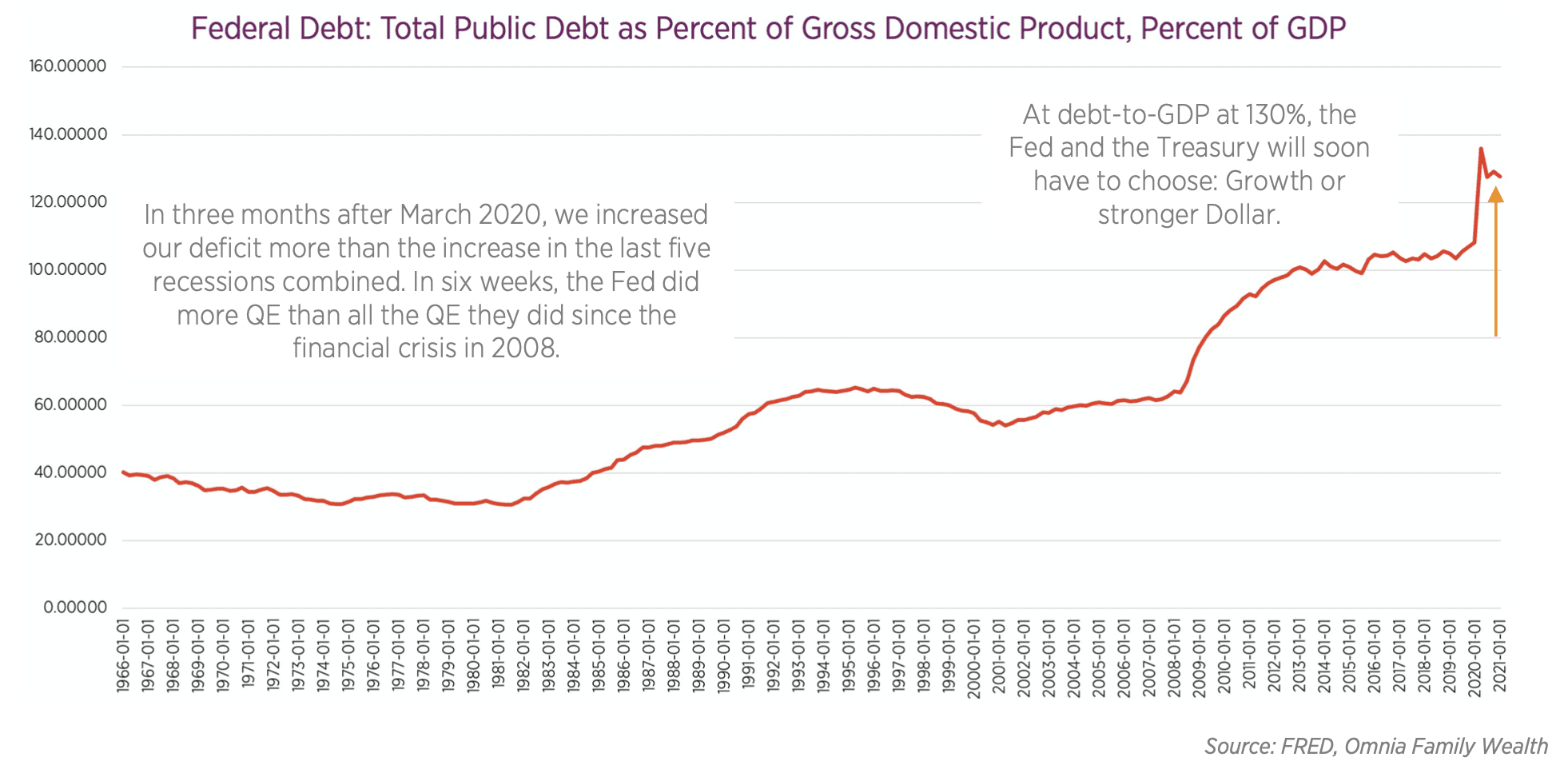

I believe the treasury market got too big for local and foreign demand, which makes the ability of the Fed to step out of the market almost impossible. The monetary “emergency” operations since 2008 will have to continue one way or another. At a rate of $120 billion in treasury and other debt purchases a month, who will replace the Fed?

The Fed is fighting gravity, holding long-term rates glued to the floor. If the Fed stops purchasing treasuries, what will happen to long rates? And then what will that do to equity valuations?

I see the recent announcement by the Fed to have a permanent Repo facility as another piece of evidence. In the case of foreign investors who need to sell treasuries for whatever reason, but mostly if the dollar strengthens, can instead use their currency as collateral in the Repo facility and get the dollars they need.

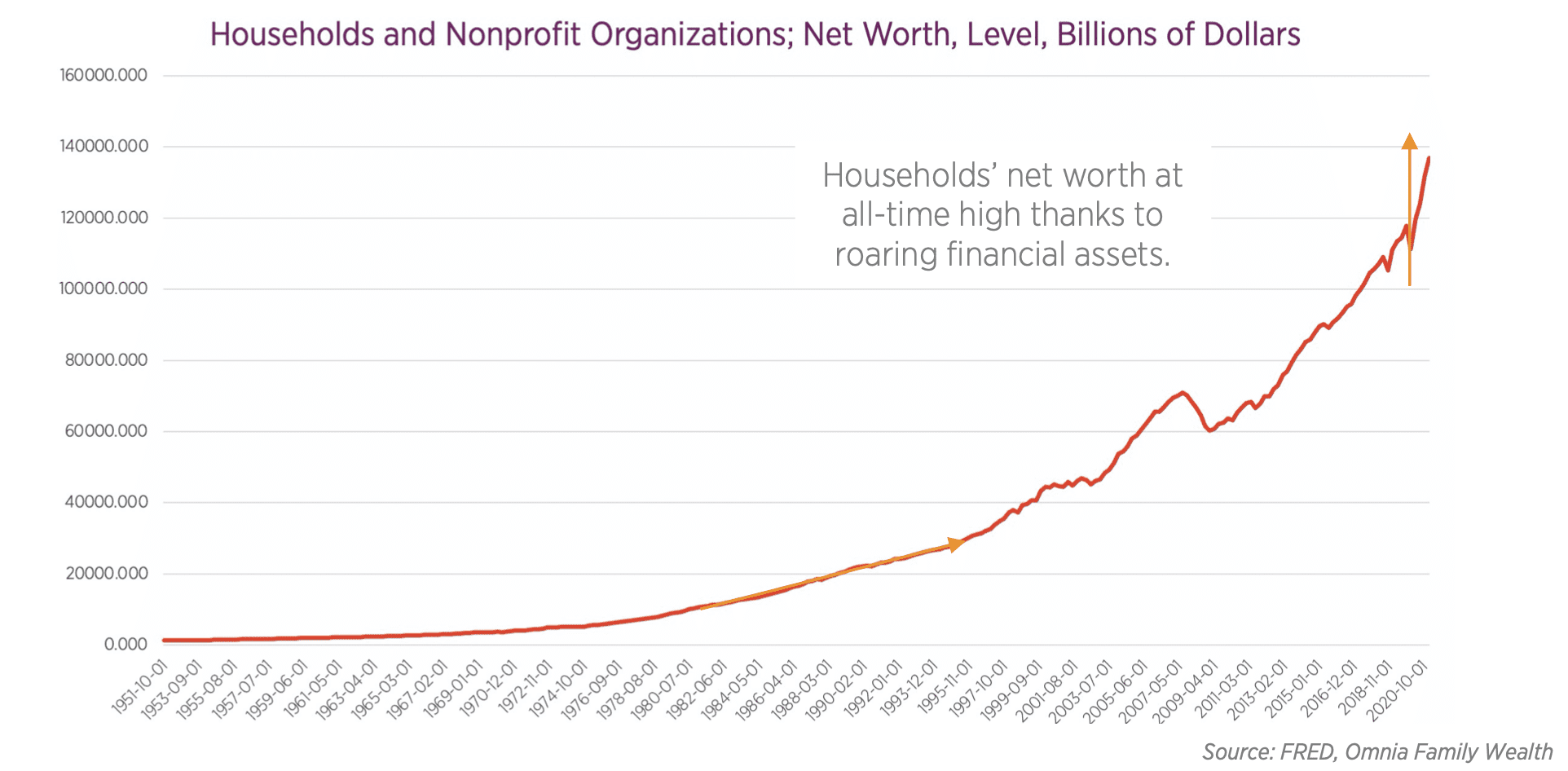

Because we run such high deficits, the Fed can’t allow equity markets or real estate to collapse or just be down for a long time. In the last 20 years, every time we had a bubble burst, tax receipts fell significantly, and with growing interest expenses and entitlements, we can’t afford it.

Here again, it’s impossible to predict when or what will happen to long-term rates, but based on what we see, equity markets and the fixed income markets can’t handle high rates. So, you have to ask yourself what could be the implications of high rates, and if they are severe enough, what do you do to mitigate them?

Choose Strong US Dollar or US Jobs

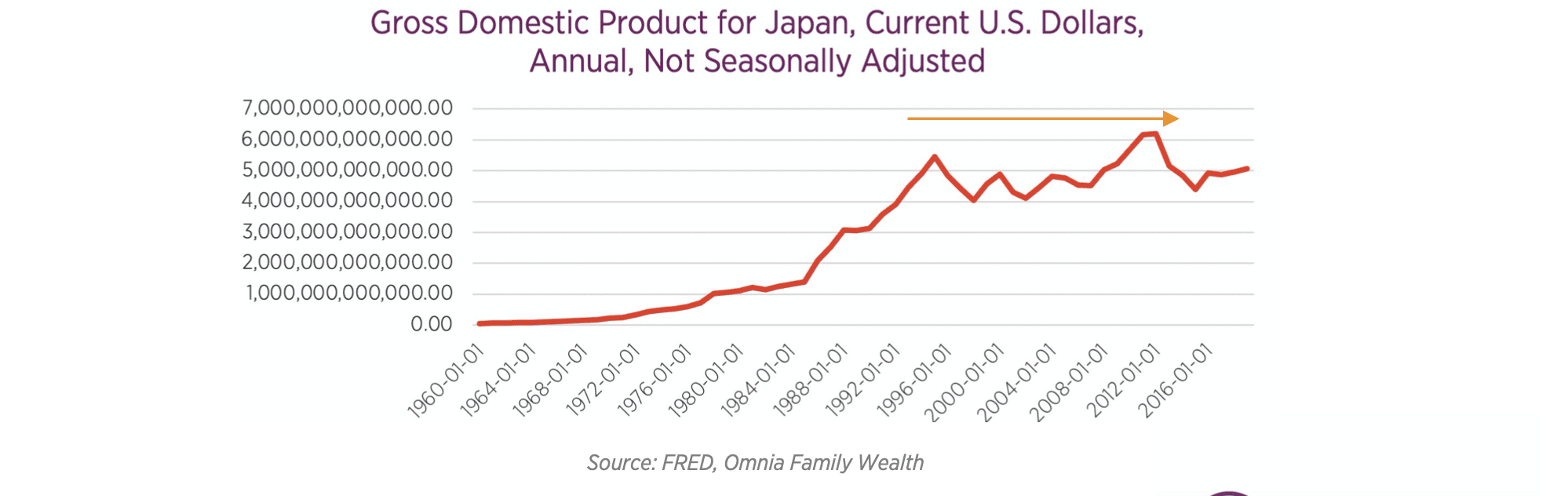

I’m concerned the privilege of having the world reserve currency is turning into a burden and a roadblock to US growth. It benefited the US for a long time, but it also resulted in major trade deficits, budget deficits, and the loss of the manufacturing sector. There are heavy costs to minting a reserve currency. Now, at 130% debt-to-GDP and the intention for borrowing trillions more, the question is how far we can push and borrow before we have to choose between a strong dollar and growth. Japan is a good example of a country that owns most of its debt and has had zero rates for a very long time but also hasn’t been growing. This is a longer-term concern, but the consequences for portfolios would be significant.

It’s Like Competing in an Olympic Sport You’re Not So Good At

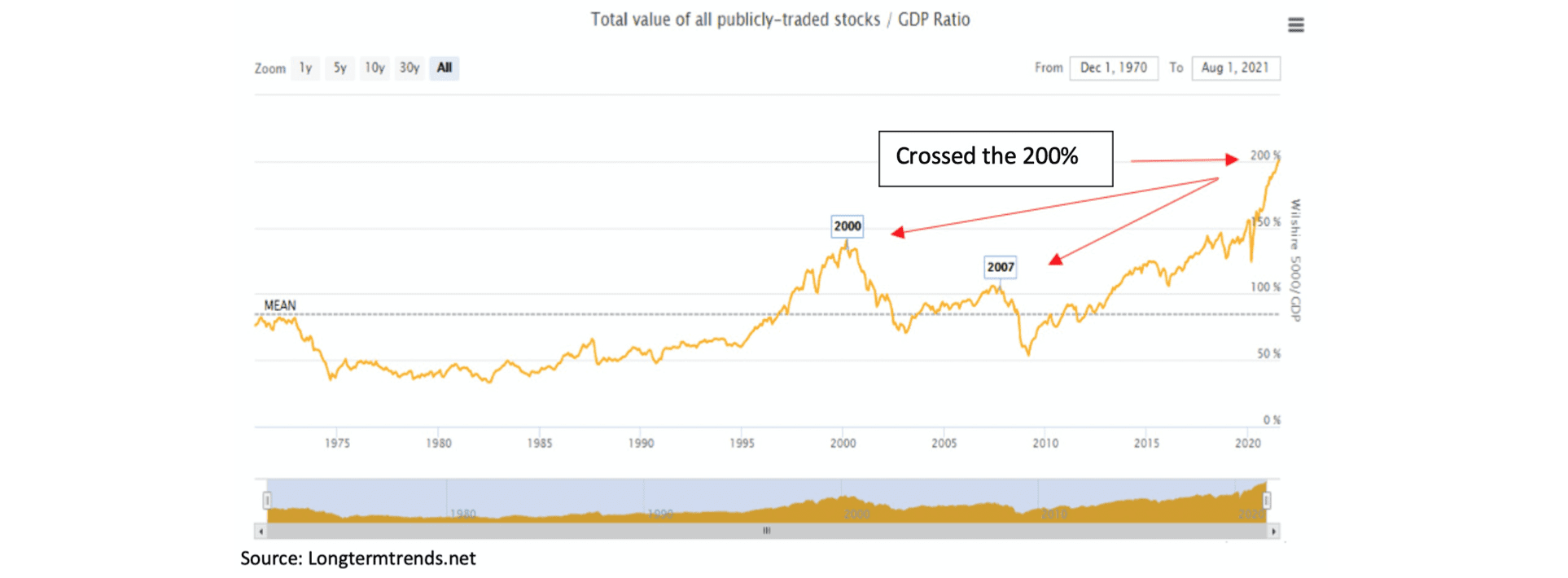

Playing these markets feels to me like playing a sport I’m not good at or have a disadvantage, like basketball. I’m very fast but too short. It’s really not fun to keep losing. So, what do I do? I play a different game. I play soccer. Now that’s a game in which my speed is an advantage, and my height is not a problem. Why am I telling you this? Because investing in markets today the way most investors do is a losing game. The probability of us “winning” keeps getting smaller because we lack the right “skills” or assets. Bonds today provide more risk than return, public equities are expensive, interest rates are at zero, real rates are negative, credit spreads are extremely tight, junk debt has very low default rates, for the first time ever, junk debt yield is lower than inflation, cap rates in real estate are very low and private companies, especially tech startups, sell at crazy valuations.

The chart above is the Buffett Indicator. It’s the ratio of total US stock market valuation to GDP. Buffet once called it “the best single measure of where valuations stand at any given moment.” Such levels mean we have been borrowing much of the expected returns from the future. There’s no free lunch.

Playing a different game means looking for strategies and assets with a better risk-reward profile, where we should expect better compensation for the risk we take. They will probably be out of consensus and out of favor or just “boring” compared to other markets. It might also take longer for them to shine, and they might look like losers for a while. Playing a different game also means avoiding strategies or assets with inferior risk-reward profiles, even if it’s the hottest play in the market right now.

A good investor needs to have the stomach to invest against consensus and even be wrong (or too early) for a while, it is often very stressful and unrewarding, but a good process will lead you in the right direction.

I would also recommend the same to the Fed and the government. We are at a point where for every dollar we add in debt, we get less and less economic benefit. They need to switch games, find a different way to create long-term growth. It is possible! This is the USA sputnik moment all over again.

Today there are several high magnitude events with increasing probabilities investors should consider. Whether they happen or not, or when they happen, isn’t important. These scenarios have the potential to severely hurt portfolios but also present wonderful opportunities if you’re ready for them.

Click here to download the article.

Omnia Family Wealth, LLC (“Omnia”), a multi-family office, is a registered investment advisor with the SEC. This commentary is provided for educational and informational purposes only. It does not take into account any investor’s particular investment objectives, strategies, tax status, or investment horizon. No portion of any statement included herein is to be construed as a solicitation to the rendering of personalized investment advice nor an offer to buy or sell a security through this communication. Consult with an accountant or attorney regarding individual tax or legal advice.

Advisory services are only offered to clients or prospective clients where Omnia Family Wealth and its representatives are properly licensed or exempt from licensure. Information in this message is for the intended recipient[s] only. Please visit our website https://omniawealth.com for important disclosures.

This content is provided for informational purposes only and is not intended as a recommendation to invest in any particular asset class or strategy or as a promise of future performance. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve.

The views expressed herein are the view of Omnia only through the date of this report and are subject to change based on market or other conditions. All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. Omnia has not conducted an independent verification of the data. The information herein may include inaccuracies or typographical errors. Due to various factors, including the inherent possibility of human or mechanical error, the accuracy, completeness, timeliness and correct sequencing of such information and the results obtained from its use are not guaranteed by Omnia. No representation, warranty, or undertaking, express or implied, is given as to the accuracy or completeness of the information or opinions contained in this report. This report is not an advertisement. It is being distributed for informational and discussion purposes only. Omnia shall not be responsible for investment decisions, damages, or other losses resulting from the use of the information. This report is not intended for public use or distribution. The information contained herein is confidential commercial or financial information, the disclosure of which would cause substantial competitive harm to you, Omnia, or the person or entity from whom the information was obtained, and may not be disclosed except as required by applicable law.

Statements that are non-factual in nature, including opinions, projections, and estimates, assume certain economic conditions and industry developments and constitute only current opinions that are subject to change without notice. Further, all information, including opinions and facts expressed herein are current as of the date appearing in this report and is subject to change without notice. Unless otherwise indicated, dates indicated by the name of a month and a year are the end of the month.