Bonds, Equities, Gold and the US Dollar

The following is a bird’s-eye view of today’s markets. As portfolio managers, our duty is to understand what drives each market and how markets interact, but it’s never simple. It is almost like assembling a puzzle with mismatched pieces from many puzzles.

This year, 2019, is reminiscent of 2017 when every asset class was up sharply. It is not often that all asset classes have such a good year simultaneously. There is a very interesting set-up developing in major markets, where at least one of the assets has to give in. it’s either stocks and other risk assets, or bonds, but if not either of these, then it’s the US dollar.

Bonds and Interest Rates

Yields across fixed income assets have been dropping as prices are higher. The most notable drop is in the 10-year Treasury yield. To read about the drop in Treasury yields and the implications for the Fed click here. Since then, other captivating events have unfolded. On June 18, the French and Swedish 10-year government bond yields turned negative for the first time. To put this into perspective, there are now over $13 trillion in bonds yielding less than zero, representing 26% of global sovereign debt. The other significant event is that the LIBOR yield curve inverted for the first time since 2008. The recent action in Treasury yields is a continuation of what we saw and wrote about last year. With our economic indicators weakening, falling long-term yields point to financial conditions in the US possibly beginning to deteriorate as is evidenced in the housing sector, Chicago ISM, capital goods orders and corporate CAPEX. At its next meeting, the Fed, it is presumed, will need to cut rates by 50 basis points. We also see the Fed launching another QE program to support the economy down the road.

For these reasons, we have been holding long-term Treasuries. If growth and inflation projections are falling in a country, you want to own the long-term sovereign debt. This all will affect corporate bonds. We steer clear of this asset class because of the high risk and low returns offered. The debt level among the riskiest companies in the US is a big problem. Corporate debt to EBITDA is at extreme levels. BBB-rated bonds were 30% of the investment grade pool when this cycle started. Now they are 50% and their debt-to-EBITDA ratio is higher than the average in the high-yield market.

US Equities

While the action in treasuries is a warning sign, the stock market sees this as a positive. Investors expect lower interest rates and additional stimulus from the Fed. US equities are up strongly this year — around 18% as I’m writing this.

The stock market is right about one thing: The Fed cannot let equities fall too hard. The stock market enabled the Fed to start raising rates and it also forced them to stop raising rates in December 2018.

It might sound surprising, but with all the stimulus/QE since 2008, credit growth has been too sluggish to make the economy grow. Rising financial asset prices drove growth. The Fed’s massive stimulus raised household net worth, which helped keep the economy from falling into a recession, but even then, the average GDP was just 2.3%.

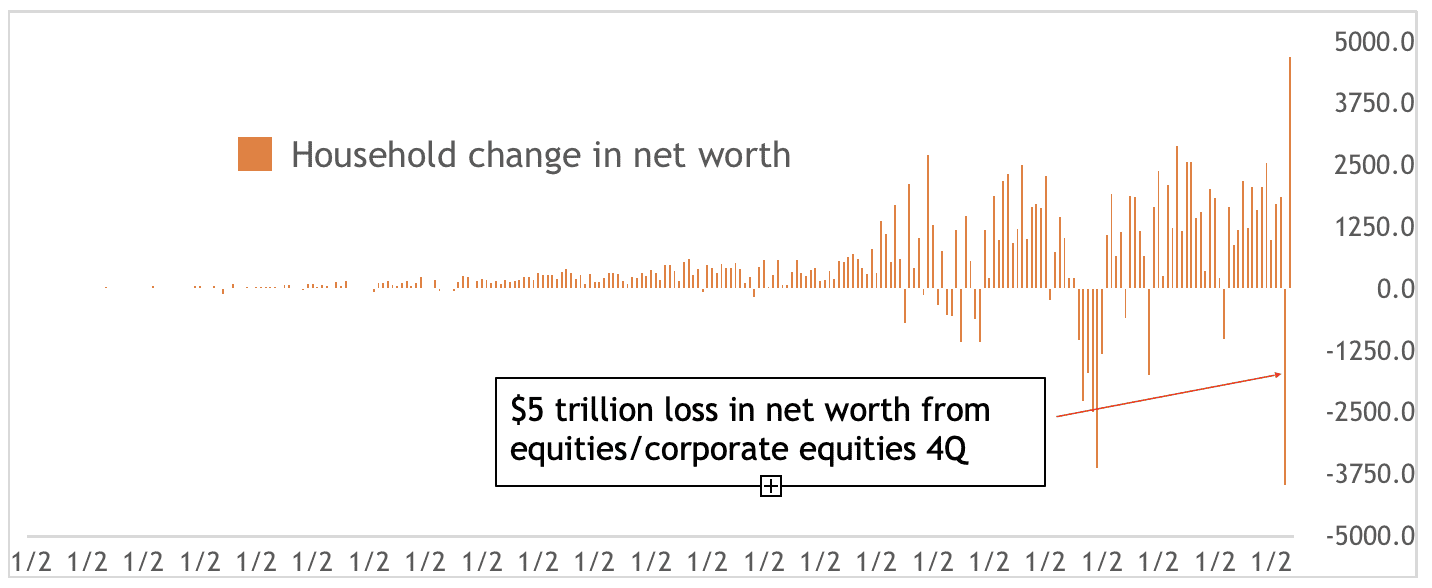

As evident in the next chart, the drop in equities in the last quarter of 2018 eliminated $3.96 trillion of household net worth. $5 trillion was through equities (there was a small increase in real estate and other assets). The Fed knows a loss of net worth this size could throw the economy into a recession.

Source: FRED, Omnia Family Wealth

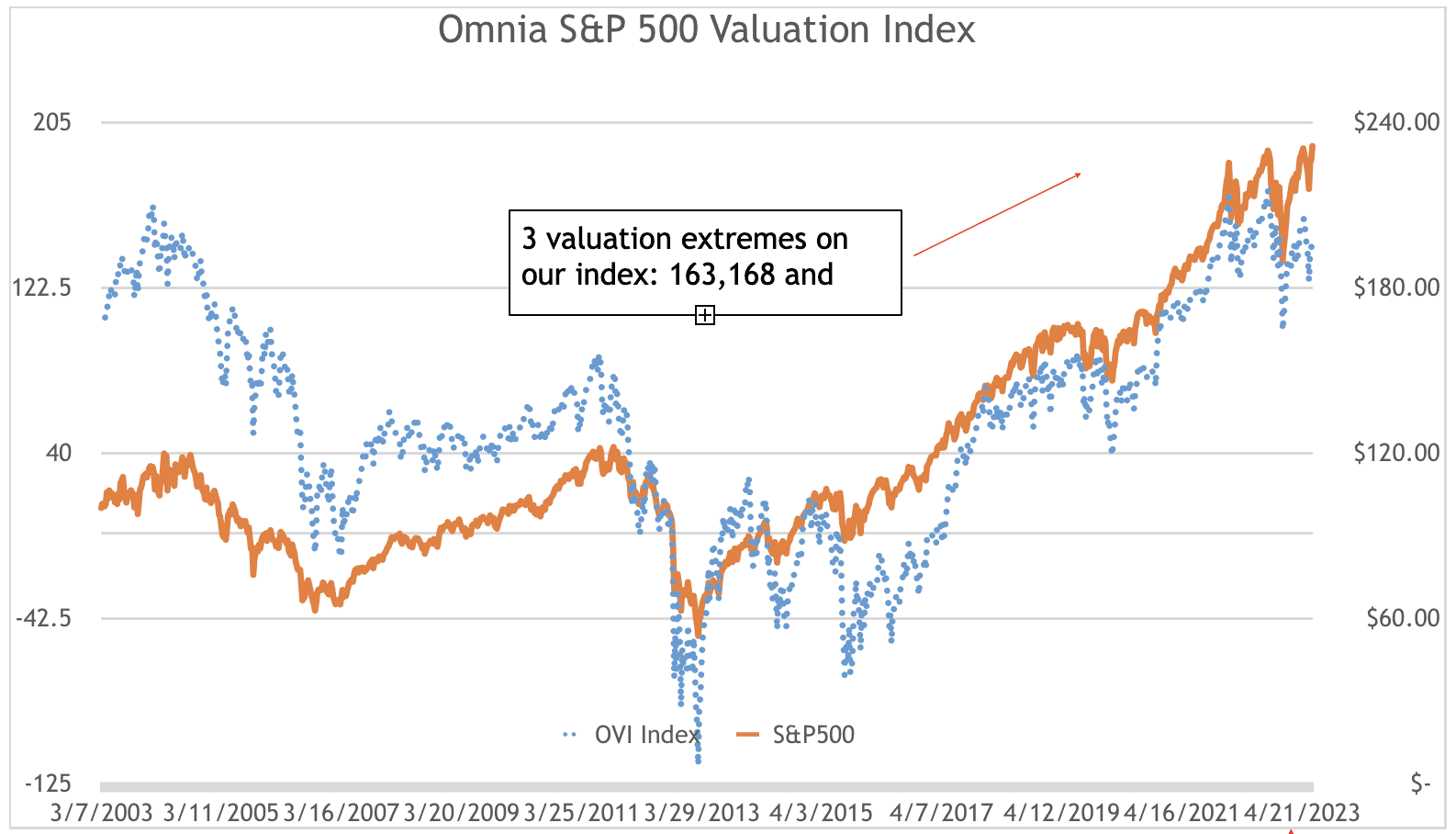

While we agree with the stock market’s view about the Fed, and higher equities are a possibility, we are less optimistic for the longer term. Historically, when the Fed lowered interest rates before a recession like in 1999, 2001 and 2007, the market rose initially, but then it reversed trend. The main reason we are not so excited about US equities is valuations. US equities are having a great 2019, but looking at a longer period, the market generated just about 5% since late January 2018. The S&P 500 reached new highs three times since January 2018 at close levels, but as can be seen in our valuation model, the market wasn’t able to hold these levels.

Source: Omnia Family Wealth

Gold

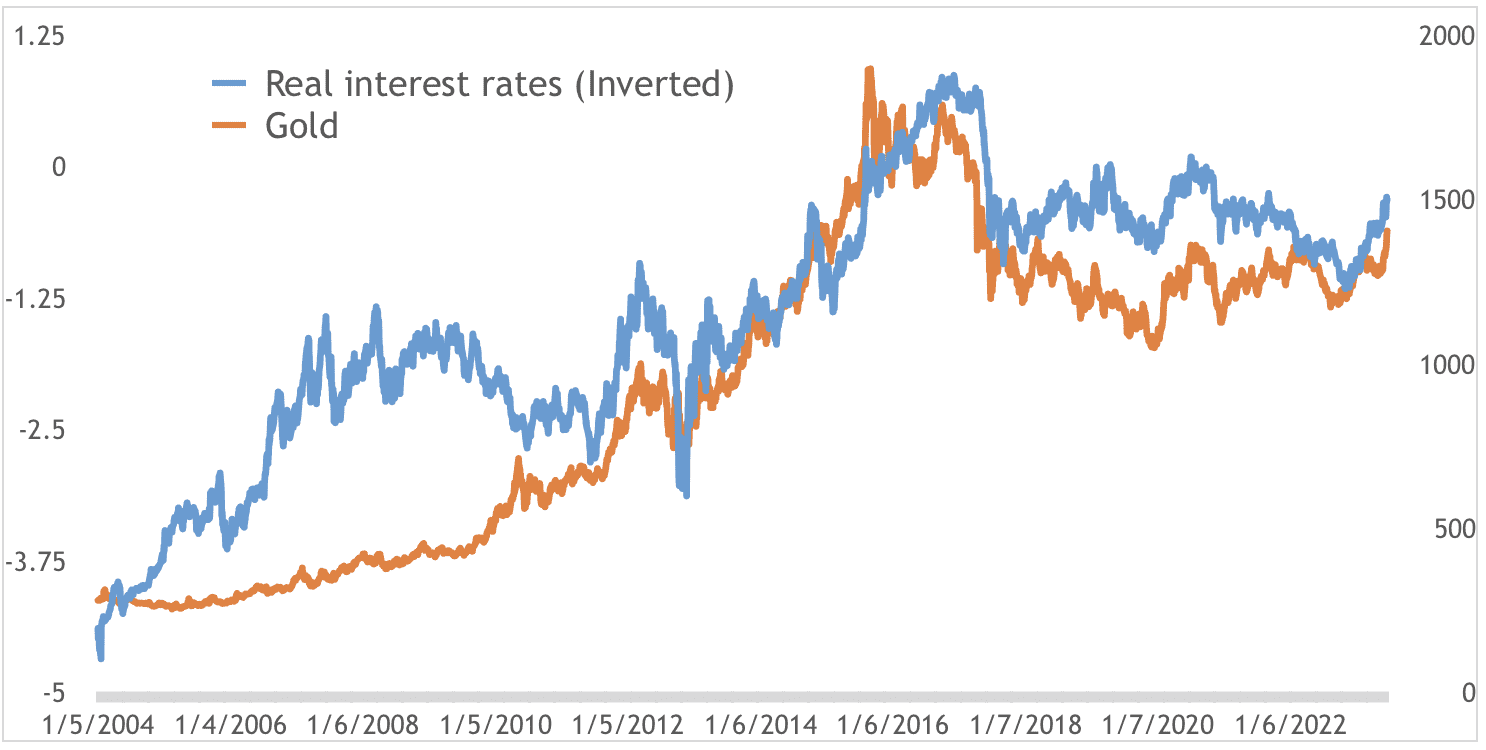

Gold had a nice run up in the last few weeks. This drew investor attention and many are asking about gold. Gold is one of the most controversial asset classes. It means different things to different investors at different times. Some love it and some hate it. One of the ways we look at and invest in gold is as an absolute return currency. This means that gold’s value is determined by real interest rates (see the chart below). The lower real interest rates are, the higher the value of gold should be. The recent bounce in gold is mostly due to the sharp drop in long-term yields (10-year Treasury yield is at 2%). However, investors should remember that inflation expectations are falling as well. This could cause real rates to go higher. Other than long-term yields and inflation expectations, we look at the US dollar as the most important trigger for higher or lower gold prices. Two additional longer-term stories with gold are the efforts of China, Russia and some European countries to make gold part of the monetary system again as a way to shift the world away from the dollar, and the potential bursting of the sovereign debt bubble that could send gold significantly higher. This is worth watching.

Source: FRED, Omnia Family Wealth

US Dollar

The US dollar is always the most important story to follow and to some, the dullest. The dollar story is also a complicated one with a lot of moving parts worthy of deeper discussion. To understand the main story of the dollar today, we need to look at the government projected deficit and the Treasury market.

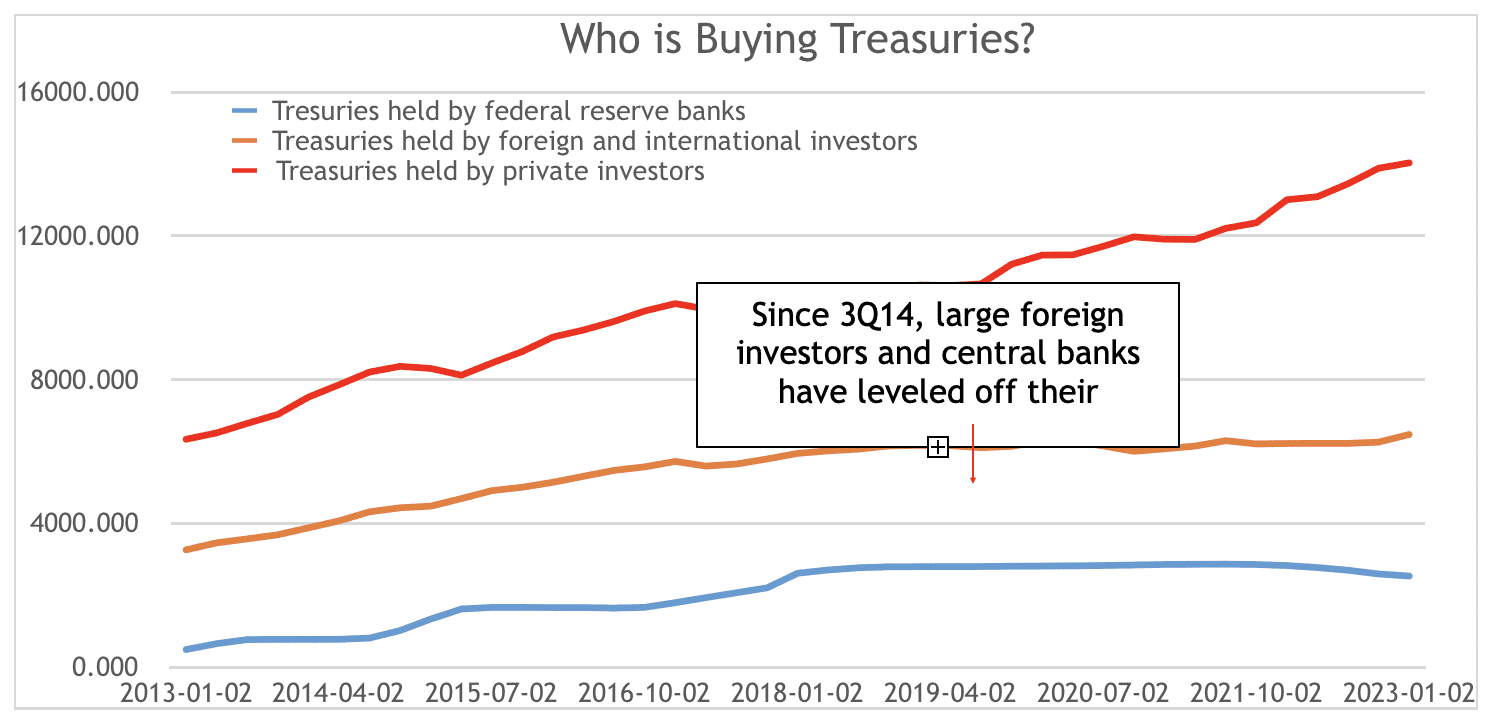

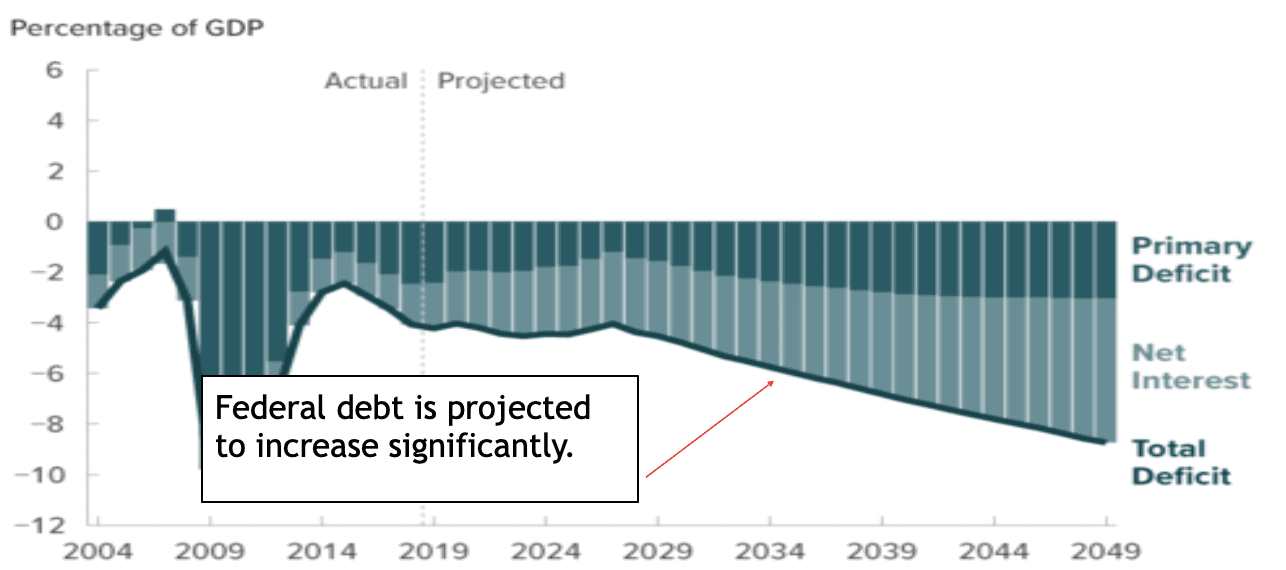

As government deficits increase, new bond buyers are needed. In 2014, the Fed stopped buying treasuries, so somebody else had to pick up the slack. Contrary to previous years, foreigners, especially central banks, are not piling up on federal government debt. As can be seen in the chart below, domestic private investors are the main buyers of federal debt. At the same time, the Congressional Budget Office is projecting a massive deficit increase that will need to be financed by new debt (chart below). This shift in ownership raises concerns and could have important implications for investors. At some point, the US deficits could force the Fed to inject dollar liquidity to markets, which could then weaken the dollar significantly. Major developments are coming in the Federal Reserve policy. The Fed may not just be acting to support the markets and economy as mentioned above, but also to help the US government finance its growing debt.

Source: US Department of the Treasury, Omnia Family Wealth

The 2019 Long-Term Budget Outlook

Source: Congressional Budget Office, Omnia Family Wealth.

As we continue to work on assembling the puzzle, the picture becomes clearer, but there is always the possibility more mismatched pieces will be added.

Download this Omnia Observations commentary here.

Important Information

Omnia Family Wealth, LLC (“Omnia”), a multi-family office, is a registered investment advisor with the SEC. This commentary is provided for educational and informational purposes only. It does not take into account any investor’s particular investment objectives, strategies, tax status, or investment horizon. No portion of any statement included herein is to be construed as a solicitation to the rendering of personalized investment advice nor an offer to buy or sell a security through this communication. Consult with an accountant or attorney regarding individual tax or legal advice.

Advisory services are only offered to clients or prospective clients where Omnia Family Wealth and its representatives are properly licensed or exempt from licensure. Information in this message is for the intended recipient[s] only. Please visit our website https://omniawealth.com for important disclosures.

This content is provided for informational purposes only and is not intended as a recommendation to invest in any particular asset class or strategy or as a promise of future performance. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve.

The views expressed herein are the view of Omnia only through the date of this report and are subject to change based on market or other conditions. All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. Omnia has not conducted an independent verification of the data. The information herein may include inaccuracies or typographical errors. Due to various factors, including the inherent possibility of human or mechanical error, the accuracy, completeness, timeliness and correct sequencing of such information and the results obtained from its use are not guaranteed by Omnia. No representation, warranty, or undertaking, express or implied, is given as to the accuracy or completeness of the information or opinions contained in this report. This report is not an advertisement. It is being distributed for informational and discussion purposes only. Omnia shall not be responsible for investment decisions, damages, or other losses resulting from the use of the information. This report is not intended for public use or distribution. The information contained herein is confidential commercial or financial information, the disclosure of which would cause substantial competitive harm to you, Omnia, or the person or entity from whom the information was obtained, and may not be disclosed except as required by applicable law.

Statements that are non-factual in nature, including opinions, projections, and estimates, assume certain economic conditions and industry developments and constitute only current opinions that are subject to change without notice. Further, all information, including opinions and facts expressed herein are current as of the date appearing in this report and is subject to change without notice. Unless otherwise indicated, dates indicated by the name of a month and a year are the end of the month.