Risk Below the Surface

Omnia CIO Discusses the Deteriorating

Standards in the Credit Market

Recently a colleague called me to ask about Delaware’s new amendment allowing limited liability companies (LLCs) to split to one or more additional LLCs and move assets and liabilities between the old and new entities. He asked if this change could affect portfolios invested in bank and other leveraged high-yield loans. The short answer is yes, and we’ll explain why in this commentary.

What changed?

In summary, the new change to the Delaware LLC Act (effective August 1, 2018) allows a Delaware limited liability company to divide itself into two or more LLCs and allocate assets and liabilities among itself and/or the newly formed LLCs. Each LLC is then responsible only for the liabilities that were allocated to it.

To take a very simplified example, let’s say an investor gives a loan to an LLC that owns two buildings. The loan is secured by the assets – the two buildings. One morning the investor finds out that the LLC was divided into two companies and one of the buildings was allocated as an asset to the newly formed LLC. That means he has less collateral for his investment/loan. (It’s not always the case in old agreements because the amendments allow liens to continue on assets notwithstanding the division).

Now, many loan agreements typically prohibit mergers, asset sales and similar transactions, but currently, most do not consider divisions.

I explained to my colleague that due to this amendment, existing covenants should be examined to decide if they require an update and a specific reference to divisions. Investors should take these agreements to their attorneys to be reviewed. This is most critical for investors who lend money directly to Delaware LLCs and when dealing with smaller borrowers with inexperienced management.

The Amendment is a Wake-up Call for Lenders

My colleague’s concerns are legitimate, and his question made me realize how unaware investors are to deteriorating covenants in credit markets.

Covenants are lenders’ tools to make sure borrowers behave in a financially prudent manner to help ensure they will repay the debt. There are financial covenants and operational or affirmative covenants. Financial covenants are usually ratios that the borrower is required maintain, such as debt-to-equity ratio or interest coverage ratio, and also restrictions on debt levels and minimum working capital requirements. Operational covenants often require borrowers to keep their physical assets at certain standards and maintain healthy operation of their businesses.

In practice, borrowers did not have to wait for this amendment to be able to shift assets and liabilities between subsidiaries. The market environment in the last few years has allowed borrowers, especially ones backed by large private equity sponsors, to decide the terms.

Lenders keep waiving their right to stop companies from raising additional debt even when it brings their leverage to critical levels. This is happening not only in the US. In the last quarter of 2017, eight out of 10 deals in Asia had such provisions in their loan agreements.

The J. Crew Trapdoor Example

Using some poorly written language in its loan agreement covenants that later became known as the J. Crew Trapdoor, J. Crew used a “back-door” provision to transfer approximately $250 million worth of intellectual property to an unrestricted subsidiary with the aim of borrowing against the transferred assets and using the proceeds to repay other debt.

Weaker Covenants

A covenant-lite loan does not mean there are no covenants to protect the lender. For most loans, it means they lack the financial maintenance covenant portion. The lack of a financial maintenance covenant limits the restrictions on the debt-service capabilities of the borrower. It removes the early warning signs lenders usually have through traditional covenants, such as reporting requirements on loans to value and EBITDA (earnings before interest, taxes, depreciation and amortization) ratios. They weaken the ability of lenders to take steps to mitigate a possible default.

The Worst Combination

The biggest risk appears when joining the two together: weak financial maintenance covenants and a loophole that allows a company’s restricted subsidiaries to make investments in unrestricted subsidiaries for the purpose of moving value away from creditor control. Investors should really be weary of this type of situation.

Current Market Environment

The last decade of low interest rates with the help of weak financial covenants delayed the occurrence of defaults and allowed “zombie” companies to stay afloat. Zombie companies are ones with EBITDA that is lower than the interest they need to pay on their debt. According to Bianco Research, 14 percent of firms in the S&P1500 are “zombies.”

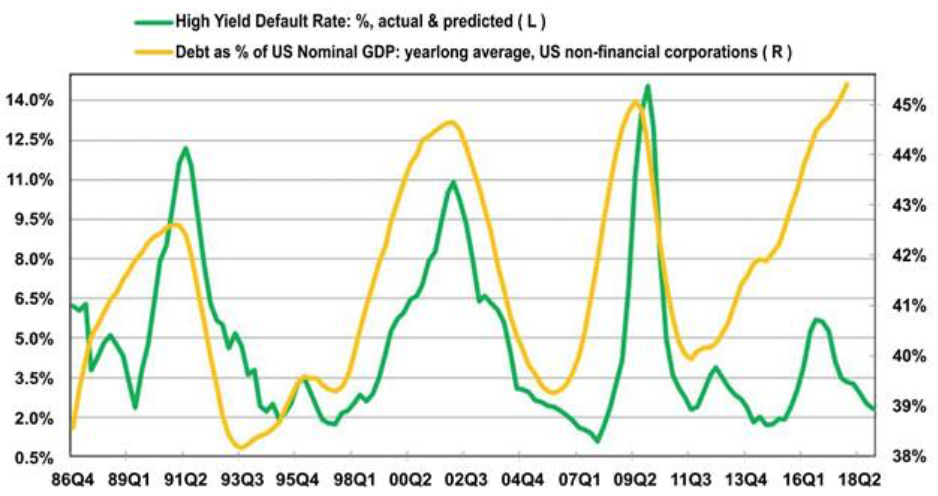

The chart below demonstrates the problem. Record low interest rates broke the 30-year correlation between the high-yield default rate and US non-financial corporate debt to GDP. This is unsustainable.

Source: MarketWatch

Low interest rates also inflated the size of the US high-yield bond market and leveraged loan market, which are now both close to double what they were in 2007.

This “trend” can be found in mid-market leveraged buyouts as well. In some deals we reviewed, leverage was above seven times EBITDA. In addition, some firms will use non-GAAP financial measures, which certainly will increase reported profitability.

Higher Risk for High-Yield Bonds

The loopholes mentioned above in senior secured loans also increase the risk of high-yield bonds because they give a borrower the ability to add unlimited secured debt ahead of unsecured bonds. Covenant-lite loans have more covenants than high-yield bonds which are typically unsecured.

What Should Investors Do?

One thing investors should consider is avoiding fixed income ETFs. These are passive vehicles that are index-based and are agnostic to value and quality. BBB rated bonds, which are at the bottom of the investment-grade market, account for about 50 percent of the Bloomberg Barclays investment-grade bond index, compared to 38 percent before the financial crisis. Many of these bonds should not even be classified as investment-grade debt.

The most important thing investors should do is review their allocation to credit instruments – specifically to high-yield bonds and bank loans for hidden risks and leverage that could change the nature of the original investment. While the economy is still strong, with low rates and high liquidity, this is the time to be very selective in the credit space.