Current Private Equity Markets and the Internal Rate of Return Fallacy

So first, after reading this you might think I am hesitant or opposed to private equity. Please do not misunderstand my cautionary assessment. Private equity is an important component in long-term portfolios. As a former endowment CIO, I have invested in many private equity funds across many strategies. Today, we still work with some of the most talented PE managers, but what I see today concerns me a lot.

The Current Environment

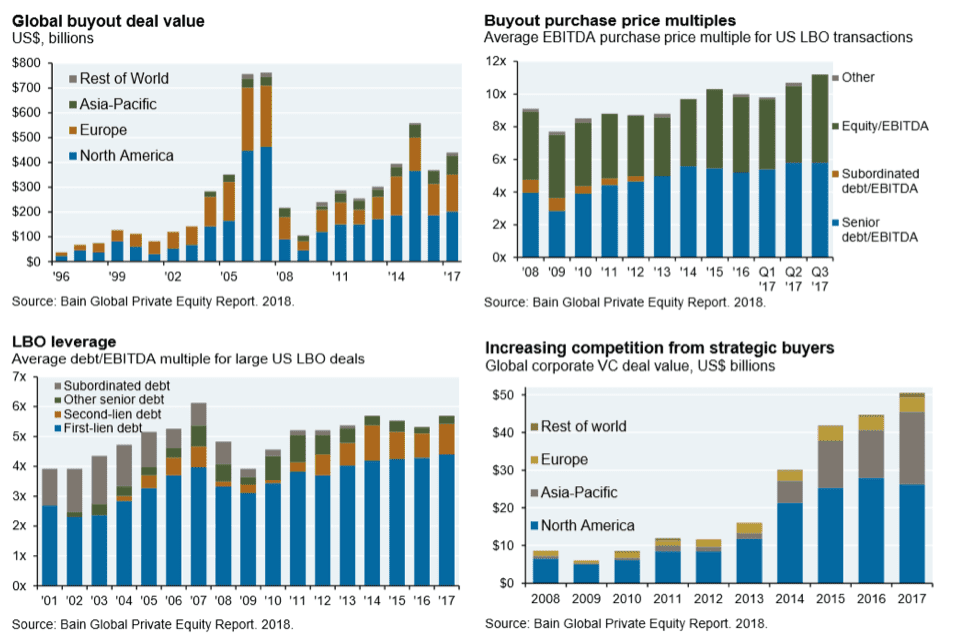

The number of PE funds reached an all-time high in 2018. Dry powder, or money ready to be called and deployed by PE funds, is estimated to be between $1 – $1.5 trillion. I am not surprised to see this activity at this stage of the cycle. With lower expected returns in public equity and fixed income markets and the promise that long-term PE funds produce higher returns than public markets, institutional and individual investors are increasing their allocation to PE funds.

This environment has also created the most misleading and sometimes overstated past and future performance presentations I have ever seen. We now see more often managers presenting high IRR’s and top quartile rankings. I also think this is one of the reasons investors are looking to allocate so much capital to this asset class.

The Fallacy of IRR

The IRR (internal rate of return) method has its advantages, but the way it is being used and reported by many funds makes it a horrible measure for the success of PE funds. It is so misunderstood that I recommend that investors who do not understand how IRR is calculated and its pitfalls to not look at it at all when examining a fund’s returns.

If you inquire, you will be amazed to see how many investors think that a 25% IRR means the fund made 25% annually through the time of the investment.

Every investor is familiar with the past performance disclaimer found in any investment fund presentation: “Past performance is no guarantee of future results.” But guess what the IRR is doing? The main problem with the IRR calculation is the assumption that cash proceeds are reinvested at the same IRR for the entire investment period. For example, if a fund returned capital at an early stage and reported an IRR of 40%, the IRR calculation then assumes the money that was distributed is put to work at the same IRR of 40%, but in reality, no investor will really receive the equivalent cash returns.

The IRR calculation puts a lot of weight on the earliest cash flow, how quickly a fund deployed capital and how quickly they returned capital will have significant effect on the IRR. This effect will sometimes overstate IRR by two times or more.

Start with Cash on Cash Multiple

The simplest way to approach this is by first calculating the cash-on-cash return. Divide the amount distributed back by the fund by the amount invested in the fund. This is not a perfect calculation for performance, but if the IRR is overstated, it will be apparent in the cash-on-cash multiple.

The Right Way to Invest in Private Equity Funds

For us to be comfortable locking a family’s money for 10 and sometimes 15 years, we have to be as confident as possible that the returns vs. the risks offered by the fund are superior. The due diligence and selection of a PE fund is a long and complex process and should be done by professionals with significant experience. A mistake in fund selection could be very costly.

Important Disclosure

The information provided is for educational and informational purposes only and does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. You should consult your attorney or tax advisor.

The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

Omnia Family Wealth LLC (“Omnia Family Wealth”) is a registered investment advisor. Advisory services are only offered to clients or prospective clients where Omnia Family Wealth and its representatives are properly licensed or exempt from licensure.

Risk DisclosurePrivate equity (or other alternative investment funds) are designed only for sophisticated investors who are able to bear the risk of the loss of their entire investment. An investment in a private fund should be viewed as illiquid and interests in private equity are generally not readily marketable and are generally not transferable. Investors should be prepared to bear the financial risks of an investment in private equity for an indefinite period of time. An investment in private equity is not intended to be a complete investment program, but rather is intended for investment as part of a diversified investment portfolio. Typically interests in a hedge fund are not registered under the US Securities Act of 1933, and the fund is not registered as an investment company under the US Investment Company Act of 1940 and as such, investors will not be afforded the protections of those laws and regulations. A prospective investor should carefully review all offering materials associated with private equity, including the risk factors, and should consult his or her own legal counsel and/or financial advisor prior to considering an investment in private equity.