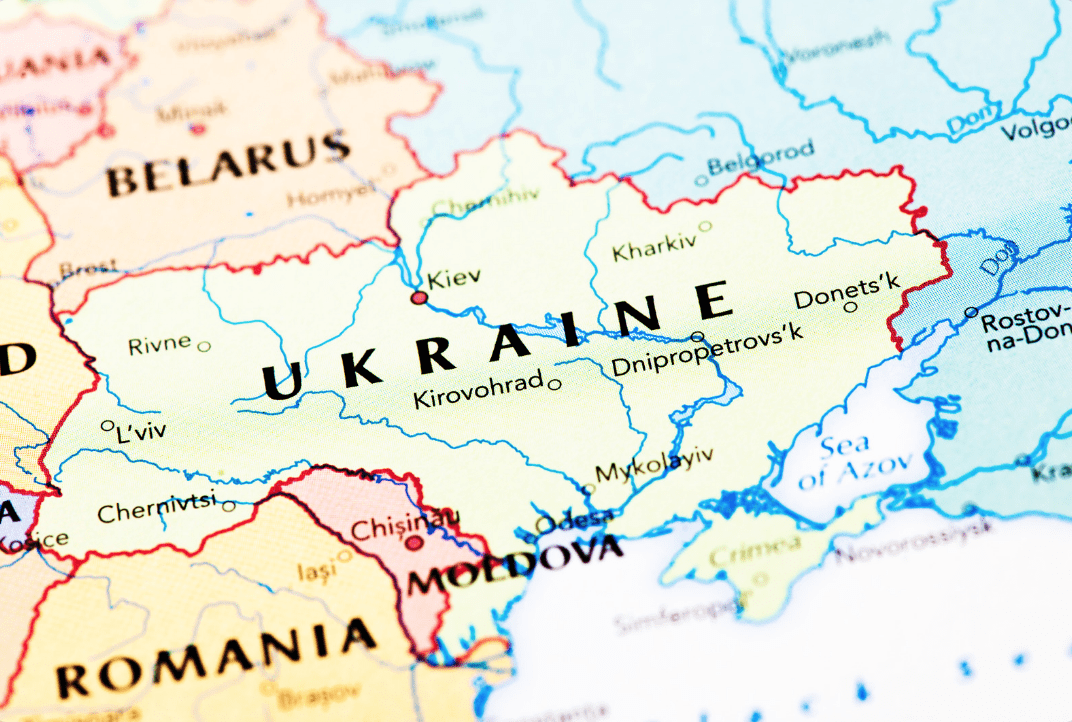

Risk in Emerging Markets: Lessons from Russia, Turkey, Iran and China

Putin’s war on Ukraine is continuing to have major domestic impacts in the U.S. and throughout the world. In isolating Russia, the EU has lost its fifth-largest trading partner, accounting for 4.8% of the EU’s total trade goods in 2020.[1] Global supply chains, already under strain, have become further destabilized. Oil is pushing $112 a barrel, and Russia warns that this can double if the West imposes energy sanctions on the Russian regime.[2] With $100 billion in Russian debt being held in foreign banks, our major financial institutions risk exposure due to Russia’s economic isolation, causing downstream financial impacts on investors. Further, as a world leader in food production and export, in the 2021-22 season, Ukraine exported 43 million tons of various grains across the globe, including 15% of the world’s entire corn supply. With this production now completely at a halt, we are already seeing a rise in food prices. This comes against a backdrop, according to the IMF, of “rapid inflation and energy prices that have been rising for months.”[3]

As costs for essential goods continue to elevate, the economic bump we were all looking forward to receiving as we came out of COVID will be further delayed or replaced with a slowdown. As such, smart investors would be well-served by creating a balanced portfolio, one that includes allocations to real assets such as commodities that provide some downside protection as we continue to ride this out.

In his seminal work, Perception and Misperception in International Politics, Robert Jervis explained that decision-makers tend to fit incoming information into their theories and images.[4] In essence, we tend to frame and interpret the behavior of others through the way we see the world rather than as an extension of the way they do. This fundamental misunderstanding has played out time and time again, with the way in which Western countries have integrated authoritarian regimes into global economic systems and agreements, heavily depending on these markets for crucial commodities, processing and manufacturing, while conveniently ignoring many obvious risks. We have seen this in our political and economic relations with China, Turkey, Russia and Iran.

It’s easy to understand why this happens. We always hear that “rising tides lift all boats” and that economic integration always leads to peaceful relations. However, we continue to make the false assumption that all states and peoples see the world the same way that we do and want the same things we want. While we all remember President Reagan’s call on Mikhail Gorbachev to “tear down this wall!”[5], we too often forget the words “If you seek liberalization: Come here to this gate!” spoken right before it.

To be clear, I am not arguing against investments in emerging markets. According to analysis by Credit Suisse, “as recently as 20 years ago, emerging markets made up less than 3% of world equity market capitalization and 24% of GDP. Today, they comprise 14% of the free-float investable universe of world equities and 43% of GDP.”[6] Many investment professionals note that economic growth in emerging markets is expected to exceed growth in developed markets in the next few years.[7] Emerging markets provide important diversification opportunities for U.S. investors as their economies are less correlated to U.S. markets as developed economies of the West. Emerging markets can also provide investors currency diversification when the U.S. dollar is weak.[8] Done well, investments in emerging markets are an important component of a diversified portfolio. Investments in ETFs, mutual funds and through seasoned money managers – as opposed to picking individual stocks and bonds – can mitigate some risk.

At the same time, emerging markets are more volatile than advanced economies, often due to political, economic and liquidity risk. Investors would be well served by doing significant due diligence research before deciding where to allocate their capital. While emerging markets have the potential to provide significant alpha, investors must always gauge whether the risk is worth the reward.

Take Turkey, for starters, which had been a darling of Wall Street over the years. Given the lack of the rule of law and due process, Turkey is prone to frequent and arbitrary regulatory changes, expropriation of private property, and politically motivated punitive tax fines against corporations. The U.S. Department of the Treasury sanctioned Turkey-based entities and individuals seven times since April 2019 for terrorism finance. The Financial Action Task Force placed Turkey on its grey list in October 2021. Ankara helped Iran and Venezuela evade U.S. sanctions, is opposed to any Russian sanctions, and remains a permissive jurisdiction for financing terrorism. Moreover, President Recep Tayyip Erdogan’s unorthodox monetary policies, which included lowering interest rates to deal with inflation, have led to a 62% devaluation of the Turkish Lira over the past three years. This triggered 54% inflation and depleted the country’s net international reserves, excluding swap deals.[9] Turkey’s Credit Default Swaps (CDS) is at 607 as of March 7, which implies over 10 percent of probability of default. This is one of the highest CDS values over the last six years.[10]

Next, consider the Islamic Republic of Iran, which is about to finalize an agreement on the JCPOA 2.0. Given Iran’s young, educated population and its energy reserves, one would expect global financial institutions to look at the country as an attractive emerging market. But, upon looking closely under the hood, the Iranian market is replete with financial and reputational risk. The economic and financial environment in Iran has been created and cultivated by bad actors to erode and ultimately kill off a genuinely competitive private sector. Iran ranks among the lowest in global transparency ranking[11], remains on the Financial Actions Task Force blacklist, is among the worst offenders in terms of corruption perception rankings and is among the toughest to conduct business.[12] Iran’s Islamic Revolutionary Guard Corps, a designated terrorist entity in the U.S. going back to 2007[13], is active in at least 20% – 30% of the Iranian economy based on conservative estimates, though the real number may be much higher due to front companies and informal nodes/networks of influence. While a new “Iran deal” will lift most if not all sanctions against the regime, many policymakers have vowed to reimpose them in the future. Surely, compliance and risk officers for major financial institutions would caution their colleagues on the risk of being on the wrong end of a future U.S. government enforcement action.

Finally, let us look at China. Given how intertwined the Chinese economy is to global markets, it is impossible to cut them off “cold turkey” overnight if one intends to invest widely in emerging markets. At the same time, investors would be well served by assessing risk before any potential returns. Recently, the ruling Communist Party has gone after the private sector industry by industry.[14] China appears to be abandoning its laissez-faire approach to its economy. For example, Didi, China’s dominant ride-hailing company, was a Wall Street darling when it went public in New York last June, raising more than $4 billion. Since then, its share price has fallen by nearly half after the Chinese government moved to limit its business two days after listing, leaving many investors – including American funds – in limbo.[15] This summer, China’s private sector suffered its harshest beating by the Communist Party in decades. With just a few abrupt orders, Beijing kneecapped the internet industry,[16] sharply curtailed the after-school tutoring business,[17] and drove some major property developers to the brink of default.[18] Add this to China’s aging population, over subsidization of industry, lack of social safety net, corrupt business practices, thefts of intellectual property and manipulation of their currency.

There is a direct lesson to be learned from our experiences with Russia, Turkey, Iran, and China on the international stage. While creative investors may seek new and innovative ways to achieve financial opportunities, these opportunities must be seen for what they are, not what we aspire for them to be. While it is impossible for investors to accurately predict the future, ongoing research on all investment opportunities, particularly for those on foreign soil, is an absolute must. Savvy investors must always consider risk and reward when considering when and where to invest, and right now, in a number of emerging markets, that risk might be too high.

Click here to download the PDF.

Sources:

[1] https://ec.europa.eu/trade/policy/countries-and-regions/countries/russia/

[2] Oil price would hit $300 if West bans Russian imports, Moscow warns (msn.com)

[3]https://www.forbes.com/sites/lisakim/2022/03/06/imf-warns-of-serious-global-economic-consequences-from-russian-invasion-of-ukraine/?sh=417b186a9845

[4] Hypotheses on Misperception | World Politics | Cambridge Core

[5] “Tear Down This Wall” | National Archives

[6] Emerging markets investments – risks and benefits (credit-suisse.com)

[7] https://www.wsj.com/articles/emerging-markets-investment-11625418130

[8] https://www.wsj.com/articles/emerging-markets-investment-11625418130

[9] Turkey’s inflation hits 54%, deepening cost-of-living woes – ABC News (go.com)

[10] Turkey Government Bonds – Yields Curve (worldgovernmentbonds.com)

[12] FATF Jurisdictions: Important Notice with respect to Iran – FIAU Malta

[13] Treasury Designates the IRGC under Terrorism Authority and Targets IRGC and Military Supporters under Counter-Proliferation Authority

[14] China’s Crackdown on Didi Is a Reminder That Beijing Is in Charge – The New York Times (nytimes.com)

[15] China opens an inquiry into Didi, two days after the ride-hailing app’s Wall Street debut. – The New York Times (nytimes.com)

[16] China Plans Security Checks for Tech Companies Listing Overseas – The New York Times (nytimes.com)

[17] China Moves Against Education Companies, Causing Shares to Plunge – The New York Times (nytimes.com)

[18] Evergrande Crisis Shows Cracks in China’s Property Market – The New York Times (nytimes.com)

Omnia Family Wealth, LLC (“Omnia”), a multi-family office, is a registered investment advisor with the SEC. This commentary is provided for educational and informational purposes only. It does not take into account any investor’s particular investment objectives, strategies, tax status, or investment horizon. No portion of any statement included herein is to be construed as a solicitation to the rendering of personalized investment advice nor an offer to buy or sell a security through this communication. Consult with an accountant or attorney regarding individual tax or legal advice.

Advisory services are only offered to clients or prospective clients where Omnia Family Wealth and its representatives are properly licensed or exempt from licensure. Information in this message is for the intended recipient[s] only. Please visit our website https://omniawealth.com for important disclosures.

This content is provided for informational purposes only and is not intended as a recommendation to invest in any particular asset class or strategy or as a promise of future performance. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve.